Managing a household on a single income requires a strategic approach to monthly budgeting that prioritizes essential expenses like housing and utilities. Establishing a dedicated emergency fund provides a necessary safety net for unexpected costs such as medical bills or car repairs. Tracking every transaction through a mobile app or a simple ledger helps identify unnecessary spending habits that can be redirected toward long term goals. Automating savings transfers ensures that a portion of every paycheck is set aside before it can be spent on discretionary items. Consistency in monitoring cash flow allows for better control over the family’s financial future.

High Yield Savings Account

A high yield savings account offers a significantly better interest rate than a traditional checking account for holding an emergency fund. These accounts keep liquid assets accessible while allowing the balance to grow through compound interest over time. Many financial institutions provide these accounts with no monthly maintenance fees to help savers maximize their earnings. Setting up an automatic deposit into this account ensures that the fund grows steadily without requiring constant manual effort. This financial tool serves as a primary defense against the uncertainty of life’s unpredictable expenses.

Debt Snowball Method

The debt snowball method focuses on paying off the smallest balances first to build psychological momentum and a sense of accomplishment. Once the smallest debt is eliminated the entire amount previously paid toward it is rolled into the payment for the next smallest debt. This strategy simplifies the repayment process by reducing the total number of open accounts quickly. It provides a clear roadmap for becoming debt free while keeping motivation high through visible progress. Consistent application of this method can lead to significant interest savings over the duration of the repayment period.

Term Life Insurance

Securing a term life insurance policy provides essential financial protection for children in the event of a parent’s untimely passing. These policies are generally more affordable for single parents compared to whole life insurance options because they cover a specific period. The death benefit can replace lost income and cover future education costs for the beneficiaries. It is vital to name a trusted guardian or a formal trust as the beneficiary to ensure the funds are managed correctly for minor children. Having this coverage offers peace of mind that the family’s lifestyle and needs will be supported.

Flexible Spending Account

A flexible spending account allows parents to set aside pre tax dollars from their paycheck to pay for eligible healthcare and childcare expenses. Utilizing this benefit reduces overall taxable income which can lead to significant savings during tax season. Funds in these accounts can be used for everything from prescription medications to summer day camps for children. It is important to estimate annual expenses accurately because many of these accounts operate on a use it or lose it basis. Taking advantage of employer sponsored benefits like this maximizes the value of every dollar earned.

529 College Savings Plan

A 529 plan is a tax advantaged investment account designed specifically to encourage saving for future higher education costs. Contributions grow tax deferred and withdrawals remain tax free when used for qualified education expenses like tuition and books. These plans are often flexible and allow the account owner to change the beneficiary to another family member if needed. Starting a plan while children are young allows more time for the investments to benefit from market growth. This proactive step helps reduce the future burden of student loans for both the parent and the child.

Career Skill Development

Investing in professional certifications or advanced training can lead to higher earning potential and greater job security over time. Many online platforms offer affordable courses that allow for learning during evening or weekend hours. Advancing one’s skillset makes a single parent more competitive in the job market and opens doors to promotions. Increased income from career growth provides more flexibility for both daily living expenses and long term retirement planning. Continuous learning is a sustainable way to improve the financial trajectory of a single parent household.

Bulk Grocery Shopping

Buying household staples and non perishable goods in bulk can significantly lower the average cost per unit for a family. Warehouse clubs often provide deep discounts on items like paper products and dry pantry goods that are used daily. Planning meals around these bulk purchases prevents frequent and expensive trips to the grocery store. Properly storing and freezing bulk meat or produce ensures that nothing goes to waste while keeping the food budget under control. This habit requires an initial investment but results in substantial savings over the course of a year.

Employee Retirement Match

Contributing enough to a 401k or similar retirement plan to receive the full employer match is essentially receiving free money. This benefit instantly doubles the impact of the contribution and accelerates the growth of the retirement nest egg. Even small contributions made early in a career can grow into a substantial sum due to the power of compounding. Prioritizing this investment ensures that a single parent is preparing for their own future while meeting current needs. Missing out on an employer match is a lost opportunity for long term financial stability.

Public Assistance Programs

Researching local and federal assistance programs can provide temporary relief for families facing tight financial situations. Programs like the Supplemental Nutrition Assistance Program or the Women Infants and Children initiative offer support for healthy food. Many communities also provide subsidized childcare or energy assistance to help manage the high costs of raising a child. Utilizing these resources during difficult times allows a single parent to focus on building a more stable foundation. Understanding the eligibility requirements for these programs is a practical step toward financial recovery.

Used Vehicle Purchases

Choosing a reliable used vehicle instead of a brand new car avoids the steep depreciation that occurs in the first few years of ownership. Lower purchase prices result in smaller monthly loan payments and often lead to reduced insurance premiums as well. Researching vehicle history reports and having a mechanic perform an inspection ensures the car is a sound investment. A dependable used car provides the necessary transportation for work and school without the heavy financial burden of a new model. Keeping a vehicle for many years after the loan is paid off maximizes its value.

Estate Planning Documents

Creating a basic will and naming a legal guardian for children is a critical step in protecting a family’s interests. These legal documents ensure that assets are distributed according to the parent’s wishes rather than state laws. Including a power of attorney and a healthcare proxy provides clear instructions if a parent becomes unable to make decisions. Consulting with a legal professional or using reputable online services can help finalize these essential protections. This preparation removes uncertainty and provides a clear plan for the care and support of minor children.

Energy Efficiency Upgrades

Small changes like installing a programmable thermostat or switching to LED light bulbs can lower monthly utility bills. Properly sealing windows and doors prevents heat loss in the winter and keeps the home cooler during the summer months. These upgrades require a small upfront cost but lead to consistent savings on energy expenses throughout the year. Many utility companies offer free home energy audits to identify areas where efficiency can be improved. Reducing energy consumption is an easy way to reclaim a portion of the monthly budget for other priorities.

Generic Brand Options

Switching from name brand household products to generic or store brand alternatives can save a family hundreds of dollars annually. Most store brand medications and cleaning supplies contain the same active ingredients as their more expensive counterparts. Many grocery stores offer high quality private labels for pantry staples like cereal and canned goods that taste identical to national brands. This simple adjustment in shopping habits does not require a change in lifestyle but significantly impacts the bottom line. Testing different generic options helps identify which ones meet the family’s standards of quality.

Automatic Bill Pay

Setting up automatic bill payments for recurring expenses like rent and utilities prevents late fees and protects credit scores. This system ensures that all obligations are met on time regardless of how busy a single parent’s schedule becomes. Many service providers offer a small discount for customers who enroll in autopay programs. Reviewing bank statements regularly is still necessary to ensure all charges are accurate and to monitor for any unauthorized activity. Using technology to manage finances reduces stress and keeps the household running smoothly.

Tax Credit Awareness

Single parents are often eligible for specific tax credits like the Earned Income Tax Credit or the Child and Dependent Care Credit. These credits can significantly reduce the amount of tax owed or even result in a larger refund check. Keeping detailed records of childcare expenses and other relevant costs throughout the year makes filing easier. Consulting with a tax professional or using specialized software ensures that every available deduction is claimed correctly. These tax benefits are designed to support working parents and can provide a meaningful financial boost.

Home Maintenance Schedule

Performing regular maintenance on home systems like the HVAC unit and plumbing can prevent major and expensive repairs later. Cleaning gutters and changing air filters are simple tasks that extend the life of a home’s infrastructure. Catching a small leak or a minor roof issue early is much cheaper than dealing with water damage or a full replacement. Keeping a simple calendar of seasonal home tasks ensures that nothing important is overlooked. Consistent care for the home protects the largest investment most families will ever make.

Side Income Streams

Exploring freelance work or a side business can provide extra cash flow to reach financial goals faster. Many single parents find success in remote roles like virtual assistance or tutoring that can be done from home. Selling items that are no longer needed through online marketplaces is another quick way to generate additional funds. This extra income can be earmarked specifically for debt repayment or a special family vacation. Finding a side hustle that aligns with existing skills makes the additional work feel more manageable.

Low Cost Entertainment

Finding free or inexpensive activities like visiting local parks and libraries provides quality family time without the high cost of commercial venues. Many museums offer free admission days or discounted tickets for residents during certain times of the year. Organizing potluck dinners or movie nights at home is a budget friendly way to socialize with friends and family. Engaging in community events often leads to meaningful experiences and new connections for both parents and children. Prioritizing these low cost options keeps the entertainment budget in check while creating lasting memories.

Negotiation of Services

Contacting service providers like internet companies or insurance agents to negotiate better rates can result in immediate monthly savings. Mentioning competitor offers or asking for current promotions often leads to a lower bill for the same level of service. It is helpful to review these costs annually to ensure the household is still getting the best possible deal. Many companies prefer to retain existing customers by offering discounts rather than losing them to a competitor. A few short phone calls can free up significant space in the monthly budget.

Child Support Enforcement

Ensuring that child support orders are officially established and consistently enforced is vital for the financial stability of the household. Utilizing state child support agencies can help track payments and address any instances of non compliance. These funds are intended to cover the basic needs of the children and are a legal right that should be pursued. Keeping accurate records of all payments received and any additional expenses shared with the other parent is helpful for legal purposes. This consistent financial contribution is a key component of a balanced family budget.

Retirement Over College

Prioritizing retirement savings over saving for a child’s college education is a difficult but necessary financial choice. While students can take out loans for tuition there are no loans available to fund a person’s retirement years. Ensuring a parent is financially independent in old age prevents them from becoming a financial burden on their children later. Children have multiple options for funding school including scholarships and work study programs. A stable retirement plan is a long term gift of security for the entire family.

Community Tool Libraries

Borrowing tools from a community library instead of purchasing expensive equipment for one time projects saves both money and storage space. Many neighborhoods have sharing programs where residents can check out lawn mowers or power drills for free or a small fee. This collaborative approach reduces the need for every household to own every possible gadget. It also fosters a sense of community as neighbors help each other maintain their homes. Utilizing these resources is a smart way to handle home repairs on a budget.

Public Transportation

Using buses or trains for daily commutes can significantly reduce the costs associated with gas and vehicle maintenance. Many cities offer discounted transit passes for regular commuters or low income households. Eliminating the need for a second vehicle or reducing the mileage on an existing one saves money on insurance and repairs. Public transit also provides a consistent schedule that can make planning the day easier for a busy parent. This environmentally friendly choice benefits both the family budget and the local community.

Meal Prep Strategy

Spending a few hours each weekend preparing meals for the upcoming week prevents the need for expensive takeout on busy nights. Having pre portioned lunches and dinners ready to go ensures the family eats healthy meals even when time is short. This strategy also reduces food waste by using up ingredients before they spoil. Kids can often get involved in the process which teaches them valuable cooking skills and the importance of budgeting. A well organized kitchen is a powerful tool for controlling household expenses.

Insurance Deductibles

Increasing insurance deductibles on auto or home policies can lead to lower monthly premium payments. This strategy works best when a parent has a solid emergency fund to cover the higher out of pocket cost if a claim is filed. The monthly savings gained from lower premiums can then be used to further boost the emergency fund or pay down debt. It is important to find the right balance between a manageable deductible and an affordable premium. Regularly reviewing insurance coverage ensures the family is protected without overpaying for high premiums.

Used Clothing Shops

Shopping at thrift stores or consignment shops for children’s clothing is a practical way to manage the costs of growing kids. Many of these items are in excellent condition and cost a fraction of the price of new retail clothing. Some stores also offer trade in programs where parents can get credit for items their children have outgrown. This sustainable shopping habit keeps the wardrobe updated without straining the monthly budget. Finding unique pieces at a low price can be a fun and rewarding experience for the whole family.

Prescription Savings Apps

Using mobile apps to compare prices at different pharmacies can lead to significant savings on necessary medications. These services often provide coupons that reduce the cost of prescriptions even for those with insurance coverage. Checking for generic versions of medications with a doctor can also lower out of pocket expenses. Some pharmacies offer flat rate pricing for common prescriptions which provides predictability for the monthly budget. Being a proactive consumer in the healthcare market is a simple way to save money.

Credit Score Monitoring

Keeping a close eye on credit scores and reports helps ensure that a single parent can access favorable interest rates when needed. Many banks and credit card companies provide free access to credit scores as part of their standard service. Reviewing credit reports annually allows for the identification and correction of any errors that might be dragging the score down. A strong credit score is essential for securing housing or obtaining affordable loans for major purchases. Maintaining good credit is a long term investment in financial flexibility.

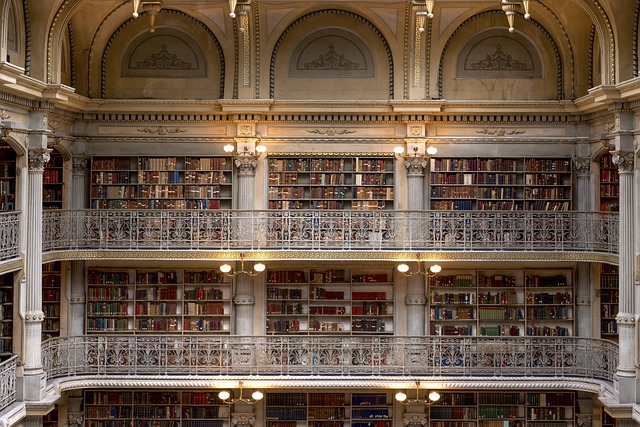

Library Resource Usage

The local public library is a treasure trove of free resources ranging from books and movies to digital classes and museum passes. Many libraries also offer free workshops on financial literacy or career development for adults. Taking advantage of these programs provides education and entertainment at no cost to the family. Digital collections allow for borrowing e books and audiobooks from the comfort of home. The library is an invaluable community asset that supports both the budget and personal growth.

Flexible Work Arrangements

Negotiating for a remote or flexible work schedule can save money on commuting costs and childcare expenses. Many employers are open to these arrangements if it can be demonstrated that productivity will remain high. Reducing the number of days spent in an office lowers the wear and tear on a vehicle and saves on professional wardrobe costs. This flexibility also allows a parent to better manage the demands of school schedules and extracurricular activities. A better work life balance often leads to improved overall well being and financial savings.

Financial Support Groups

Joining a community or online group for single parents provides a space to share tips and resources for managing finances. These groups often offer emotional support and practical advice from others who are navigating similar challenges. Hearing how others have successfully managed their budgets can provide new ideas and inspiration. Some groups also organize clothing swaps or group discounts for local activities. Building a network of supportive peers strengthens a single parent’s ability to thrive financially.

Annual Financial Review

Setting aside time once a year to review all financial goals and progress ensures that the household remains on the right track. This review is an opportunity to adjust the budget based on changes in income or family needs. It is also a good time to evaluate the performance of any investments and update insurance policies or legal documents. Celebrating the small wins and milestones achieved during the year keeps motivation high for the future. Continuous assessment is the key to maintaining a healthy and resilient financial life.

Utility Discount Programs

Many utility companies offer reduced rates or assistance programs for households that meet certain income criteria. Applying for these discounts can provide significant relief on monthly water or electricity bills. It is often necessary to provide proof of income or participation in other assistance programs to qualify. Some companies also offer payment plans that smooth out high winter or summer bills into equal monthly installments. Exploring these options ensures that essential services remain affordable throughout the year.

Zero Based Budgeting

Zero based budgeting involves assigning every single dollar of monthly income to a specific category until the balance is zero. This method ensures that all money is working toward a purpose whether it is for bills or long term savings. It prevents mindless spending by creating a clear plan for how every paycheck will be used. If there is extra money at the end of the month it can be directed toward a specific goal like an extra debt payment. This level of intentionality is highly effective for maximizing a single income.

Financial Literacy Education

Taking the time to read books or listen to podcasts about personal finance builds the knowledge needed to make informed decisions. Understanding concepts like compound interest and investment diversification empowers a parent to take control of their financial future. Many reputable organizations offer free online courses that cover the basics of money management. This education provides the confidence to navigate complex financial situations with ease. Investing in knowledge is one of the most valuable things a single parent can do for their family.

Please share your own financial tips and experiences in the comments.