Building wealth requires consistency and discipline regarding how money is earned and spent. Many individuals struggle financially not because of low income but due to repetitive behaviors that drain their resources. Identifying these subtle leaks is the first step toward securing a stable financial future. This comprehensive list highlights common actions that prevent savings growth and create unnecessary economic stress.

Paying Minimum On Credit Cards

Paying only the minimum amount due on credit cards extends the repayment period significantly. This habit allows interest charges to accumulate and often doubles or triples the original cost of the purchase. Lenders design these minimum requirements to keep borrowers in debt for as long as possible. Breaking this cycle requires aggressive payments that attack the principal balance directly.

Impulse Spending

Buying items on a whim bypasses the logical decision-making process required for financial health. Retailers use psychological triggers and limited-time offers to encourage these spontaneous purchases. This lack of planning leads to an accumulation of unnecessary clutter and a depletion of disposable income. Implementing a waiting period rule helps differentiate between genuine needs and fleeting wants.

Ignoring A Budget

Operating without a clear spending plan makes it impossible to track where money goes each month. This oversight often results in overspending on non-essential categories while essential savings goals fall behind. A written budget provides a roadmap that assigns every dollar a specific purpose before it leaves the bank account. Financial awareness acts as the primary defense against accidental overspending.

Daily Coffee Shop Visits

Buying a five dollar latte every morning drains over one thousand dollars from a yearly budget. Making coffee at home costs a fraction of the price and allows for greater control over ingredients. This small daily indulgence represents a significant opportunity cost when compounded over several years. Redirecting these funds into an investment account yields much better long-term returns.

Unused Subscriptions

Streaming services and gym memberships often charge monthly fees regardless of usage. Many consumers sign up for free trials and forget to cancel them before the billing cycle begins. These automatic deductions silently eat away at a bank balance without providing tangible value. auditing bank statements regularly helps identify and eliminate these zombie costs.

Brand Loyalty

Purchasing generic items often yields the same quality for a fraction of the price of name brands. Marketing campaigns convince shoppers that higher prices equal superior performance or taste. Store brands for medication and pantry staples usually contain identical ingredients to their expensive counterparts. breaking free from brand loyalty releases extra cash for other priorities.

Grocery Shopping While Hungry

Shoppers who enter a store on an empty stomach statistically buy more high-calorie and expensive snacks. Physical hunger clouds judgment and makes impulse items at the checkout line look irresistible. Planning meals and eating a snack before leaving the house curbs the desire to overspend. Sticking strictly to a shopping list prevents random items from inflating the total bill.

Buying New Cars

A brand new vehicle loses a significant percentage of its value the moment it drives off the lot. Depreciation is the steepest cost of car ownership during the first few years. Purchasing a reliable used model avoids this massive initial loss while still providing transportation. The money saved on depreciation can be better utilized in appreciation assets.

Emotional Spending

Many people use shopping as a coping mechanism for stress or sadness. This temporary dopamine hit fades quickly and leaves behind buyer’s remorse and less money. Addressing the root cause of emotions is healthier and cheaper than retail therapy. Finding free ways to decompress such as exercise or reading protects the wallet.

Late Fees

Missing payment deadlines results in unnecessary penalties that offer zero value in return. These fees are completely avoidable with organization and automated systems. Setting up auto-pay ensures that bills are covered on time every month. Punctuality with payments also protects credit scores from negative marks.

Keeping Up With Peers

Trying to match the lifestyle of friends or neighbors often leads to living beyond one’s means. Social media creates a false reality where everyone appears to have unlimited funds for vacations and luxury goods. Comparison is a thief of joy and a drain on financial resources. Focusing on personal goals rather than external appearances builds true wealth.

Lack Of Emergency Fund

Living without a financial safety net forces reliance on high-interest credit during unexpected crises. A car repair or medical bill can derail financial progress for months if cash is not available. Experts recommend saving three to six months of expenses in a liquid account. This buffer prevents debt accumulation when life throws a curveball.

Fast Fashion

Buying cheap clothing that wears out quickly forces consumers to replace items frequently. The cost per wear of low-quality garments is often higher than investing in durable pieces. Constantly chasing trends leads to a closet full of clothes that are rarely worn. Building a capsule wardrobe with classic items saves money and reduces waste.

Ignoring Employer Match

Failing to contribute to a 401k plan means missing out on free money provided by a company. An employer match is essentially a guaranteed return on investment that beats the market. This benefit is a crucial part of a total compensation package that should be maximized. Passing up this opportunity significantly slows down retirement savings growth.

Ordering Takeout Frequently

Restaurant meals cost significantly more than cooking simple dishes at home. Delivery fees and tips add a substantial premium to the base price of the food. Meal prepping on weekends ensures that convenient options are available during busy work weeks. reducing dining out to special occasions creates massive savings over time.

Playing The Lottery

Regularly spending money on games of chance provides a mathematically poor return on investment. The odds of winning are infinitesimal compared to the certainty of losing the ticket price. Wealthy individuals rely on calculated risks and investments rather than luck. diverting lottery funds to a savings account guarantees a winning result.

Paying For Convenience

Delivery apps and pre-cut produce charge a premium for saving a small amount of effort. These convenience costs add up quickly for tasks that take only minutes to perform. Learning basic cooking and household skills reduces reliance on expensive service providers. Time management often eliminates the need to pay for these shortcuts.

Lifestyle Inflation

Increasing spending immediately after receiving a raise prevents wealth accumulation. Many people naturally upgrade their car or apartment as soon as their income rises. Keeping living expenses flat while income grows accelerates the path to financial independence. The gap between income and expenses is where wealth is built.

Not Comparing Prices

Making large purchases without researching competitors often leads to overpaying. Price comparison tools and browser extensions make it easy to find the best deal in seconds. Many retailers offer price matching if a competitor lists the same item for less. A few minutes of research can save hundreds of dollars on electronics or appliances.

Upgrading Tech Too Often

Replacing a functioning phone or laptop every year chases trends rather than utility. Technology companies market minor updates as essential revolutions to drive sales. Holding onto devices for three or four years maximizes the value extracted from the purchase. Most users do not need the processing power of the absolute latest model.

Carrying High Interest Debt

Carrying balances on credit cards with high rates eats away at potential savings. The compound interest works against the borrower and makes every purchase cost more. prioritizing the repayment of high-interest loans is the best investment one can make. becoming debt-free frees up income for wealth-building activities.

Buying Sale Items Unnecessarily

Spending money to save money is a marketing trap that leads to acquiring unneeded items. A clearance sticker often triggers a fear of missing out rather than a rational need. If the item was not on the shopping list before the sale it is likely an impulse buy. Calculate the cost based on the money spent rather than the money saved.

Smoking

This habit costs thousands of dollars annually and increases long-term healthcare expenses. Cigarettes are heavily taxed items that provide no benefit to the consumer. The financial burden extends beyond the pack price to higher insurance premiums and medical bills. Quitting improves both physical health and fiscal stability.

Excessive Gifting

Feeling obligated to buy expensive presents for every occasion strains a personal budget. True friends and family value thoughtful gestures over price tags. Setting limits on gift exchanges or suggesting experiences can reduce holiday spending. Generosity should not come at the expense of personal financial security.

Bottled Water

Purchasing single-use water bottles costs significantly more than using a filter and a reusable container. Tap water is generally safe and free in most developed nations. The markup on bottled water is astronomical compared to the cost of production. A high-quality reusable bottle pays for itself within a few weeks.

Not Negotiating Bills

Many service providers offer lower rates or loyalty discounts to customers who simply ask. Cable and internet companies often have retention offers for those willing to call. Medical bills and insurance premiums can sometimes be negotiated down or paid via a plan. Silence is expensive when a phone call could save money.

Borrowing From Retirement

Taking money from long-term savings triggers taxes and penalties while stunting compound growth. This action steals from the future self to pay for current desires. The lost time in the market is almost impossible to recover later in life. Retirement accounts should remain untouched until the appropriate age.

Ignoring Credit Score

A low credit score results in higher interest rates on mortgages and insurance premiums. Lenders view poor credit as a risk and charge more to offset it. Monitoring credit reports helps identify errors and areas for improvement. A strong credit history opens doors to the best financial products available.

Frequent Happy Hours

Socializing at bars or pubs leads to high tabs due to the markup on alcohol. Buying rounds of drinks creates a social obligation that escalates spending. Hosting gatherings at home allows for a more controlled and affordable environment. Moderation in social spending preserves the budget without sacrificing friendships.

Leased Vehicles

Leasing a car involves perpetual payments without ever owning the asset at the end. The payments may be lower than a loan but they never end. Owning a car allows for a period of time where there is no monthly car payment. Long-term ownership is almost always cheaper than a cycle of leases.

Overspending On Housing

Committing more than thirty percent of income to rent or mortgage creates a house-poor situation. High housing costs limit the ability to save for retirement or travel. Living in a smaller space or a less trendy neighborhood releases funds for other goals. Flexibility in housing choices is key to maintaining a balanced budget.

Avoiding Bank Statements

Refusing to look at account balances allows wasteful spending patterns to continue unchecked. Denial is a common reaction to financial stress but it solves nothing. Regular reviews of transaction histories reveal the truth about spending habits. Facing the numbers is the only way to gain control over them.

No Financial Goals

Saving money becomes difficult without a clear objective or timeline to work toward. Vague intentions to save usually fail when tested by immediate desires. Specific goals like a down payment or a vacation provide motivation to sacrifice today. Visualizing the target helps maintain discipline during tempting moments.

Buying Premium Gas Unnecessarily

Most standard vehicles run perfectly fine on regular fuel rather than expensive premium grades. Unless a car specifically requires high-octane fuel for performance it is a waste of money. The difference in price per gallon adds up over the life of the vehicle. Check the owner’s manual to confirm the required fuel type.

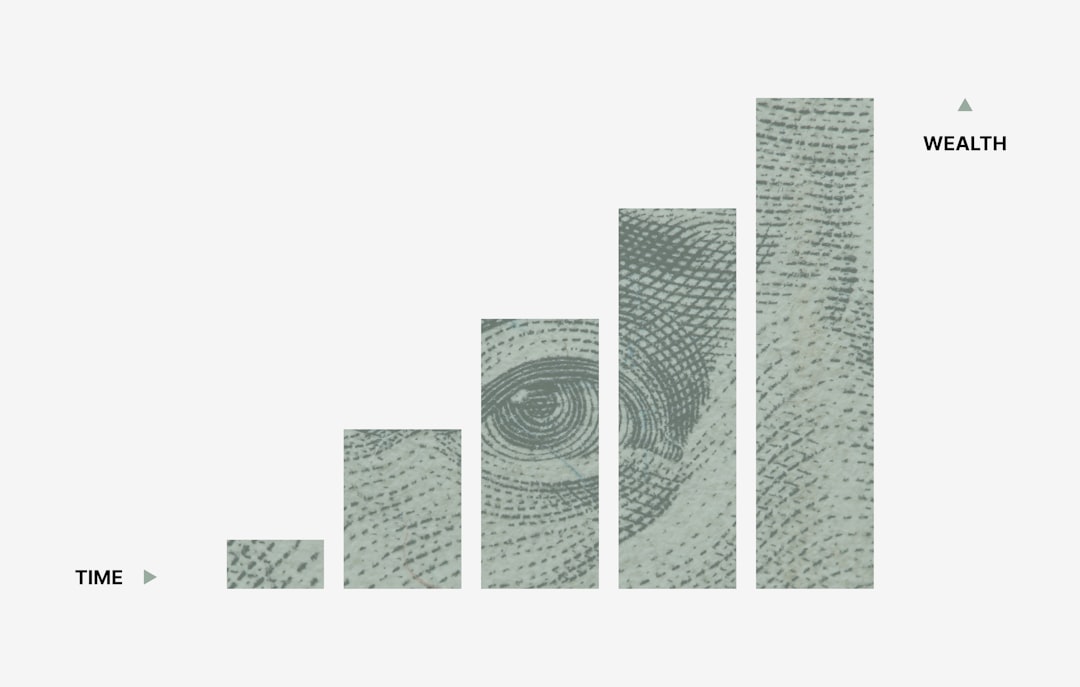

Waiting To Invest

Delaying investment contributions reduces the powerful effect of compound interest over time. Time is the most valuable asset in investing and it cannot be regained. Starting small today is better than waiting for a large sum to invest later. Consistency matters more than the initial amount when building a portfolio.

Please share your own experiences with these money habits in the comments.