Navigating personal finance during the third decade of life requires a strategic approach to long term wealth building and stability. Many young professionals overlook the compounding benefits of early investment and the risks associated with high interest debt. Establishing disciplined spending habits and a robust emergency fund serves as a critical foundation for future financial freedom. The following guide outlines common pitfalls that can hinder economic growth and delay the achievement of major life milestones.

Relying Solely on Credit Cards

Using credit cards for everyday expenses without a clear repayment plan often leads to a cycle of high interest debt. Many individuals view available credit limits as an extension of their monthly income rather than a borrowed liability. This mindset prevents the accumulation of meaningful savings and results in significant portions of future earnings going toward interest payments. Maintaining a low credit utilization ratio and paying balances in full each month are essential practices for building a strong credit score.

Neglecting an Emergency Fund

Failing to set aside a dedicated cash reserve leaves young adults vulnerable to unexpected costs like medical bills or car repairs. Without a financial cushion many people resort to taking out personal loans or using credit cards to cover basic necessities during a crisis. A standard recommendation involves saving three to six months of essential living expenses in a liquid high yield savings account. This safety net provides peace of mind and prevents the liquidation of long term investments when life events occur.

Ignoring Employer Match Programs

Missing out on a 401k match is equivalent to turning down a guaranteed addition to a total compensation package. Employers often provide a dollar for dollar contribution up to a certain percentage of an employee’s annual salary. This immediate return on investment significantly accelerates the growth of retirement accounts through the power of compounding. Prioritizing these contributions ensures that individuals maximize their benefits and build a substantial nest egg from the very start of their careers.

Overspending on Housing

Allocating a disproportionate amount of monthly income to rent or a mortgage restricts the ability to save for other goals. Lifestyle inflation often drives young professionals to choose luxury apartments that exceed thirty percent of their take home pay. This heavy financial burden leaves little room for investing or enjoying discretionary activities without incurring debt. Opting for modest housing or living with roommates can free up significant capital for wealth building during these formative years.

Delaying Retirement Contributions

The misconception that retirement is too far away to worry about leads many to wait until their thirties to begin saving. Starting a decade late requires a much higher monthly contribution to reach the same final balance due to lost compounding time. Even small consistent investments in a Roth IRA or brokerage account during the early twenties can grow exponentially over forty years. Consistency and time in the market are often more valuable than the total dollar amount invested in later stages of life.

Forgetting Regular Subscription Audits

Small monthly fees for streaming services and gym memberships often go unnoticed while draining hundreds of dollars annually. Many consumers sign up for free trials and forget to cancel before the automated billing cycle begins. These recurring costs can quietly erode a budget and reduce the amount of money available for high priority savings goals. Conducting a monthly review of bank statements helps identify and eliminate services that no longer provide value to the user.

Financing a New Car

Purchasing a brand new vehicle immediately after entering the workforce often leads to rapid asset depreciation and high monthly payments. Cars lose a significant portion of their value the moment they are driven off the dealership lot. High interest auto loans can tie up a large percentage of a young person’s income for five to seven years. Choosing a reliable used vehicle allows for lower insurance premiums and more manageable transportation costs over the long term.

Skipping Health Insurance Coverage

Going without medical insurance to save on monthly premiums exposes individuals to the risk of total financial ruin from a single accident. Young adults often feel invincible and underestimate the high costs associated with emergency room visits or specialized care. Many employer sponsored plans or marketplace options provide essential preventative services that catch health issues before they become expensive. Maintaining continuous coverage is a vital component of a comprehensive risk management strategy for any professional.

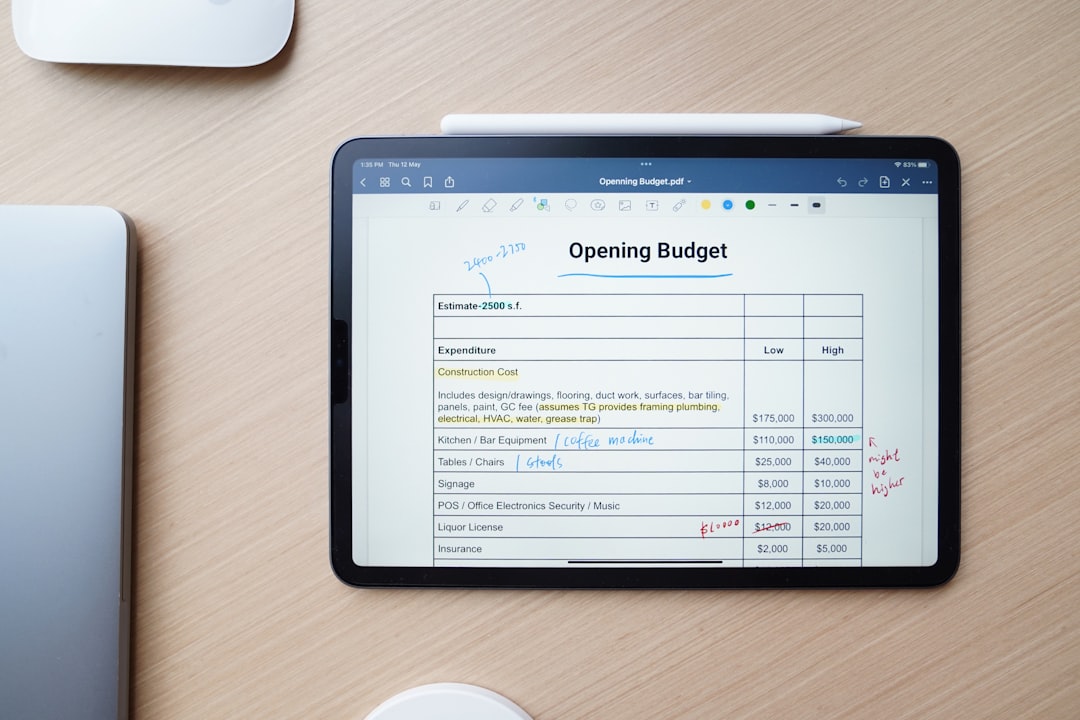

Failing to Track Daily Spending

Without a clear understanding of where money goes each day it is nearly impossible to make informed financial adjustments. Impulse purchases at coffee shops or restaurants can add up to significant sums by the end of the month. Utilizing budgeting apps or simple spreadsheets allows individuals to categorize expenses and identify areas where they are overspending. This awareness fosters a more intentional relationship with money and ensures that spending aligns with personal values.

Not Negotiating Starting Salaries

Accepting the first salary offer without research or negotiation can result in thousands of dollars in lost lifetime earnings. Future raises and bonuses are typically calculated as a percentage of the base salary which makes the initial number highly influential. Most employers expect a counteroffer and have a specific range allocated for new hires based on market data. Taking the time to demonstrate value and request a fair wage sets a professional tone for the entire tenure at a company.

Using Student Loan Refunds for Lifestyle

Treating excess student loan disbursements as free money for vacations or electronics increases the total debt burden upon graduation. These funds accrue interest from the moment they are issued and must eventually be paid back with after tax dollars. Students who return unused portions of their loans or use them strictly for educational costs significantly reduce their future monthly obligations. Minimizing borrowing during college provides much greater flexibility when starting a career and searching for housing.

Co signing Loans for Others

Taking on legal responsibility for someone else’s debt can severely impact a personal credit score and borrowing capacity. If the primary borrower misses a payment the co signer is held fully accountable for the remaining balance. This arrangement often leads to strained personal relationships and unexpected financial stress if the loan goes into default. It is generally safer to provide financial help through a one time gift rather than linking long term credit histories together.

Investing Without Basic Research

Placing money into volatile assets or complex financial products based on social media trends often leads to significant losses. Many young investors skip the fundamental step of understanding what they are buying and the risks involved. Broad based index funds or target date funds are often more suitable for those starting out than individual stock picking. Education regarding expense ratios and diversification is essential for maintaining a balanced and resilient investment portfolio.

Paying Only the Minimum Balance

Making only the minimum required payment on credit cards ensures that the principal balance remains high for decades. This strategy maximizes the amount of interest paid to the lender and prevents the user from ever becoming debt free. A small balance can balloon into a massive debt if only the minimum is covered each month. Paying as much as possible toward the principal reduces interest charges and improves the overall financial health of the individual.

Neglecting Professional Development

Failing to invest in new skills or certifications can lead to stagnant wages in a rapidly evolving job market. The early years of a career are the ideal time to attend workshops and earn advanced credentials that increase marketability. Professionals who continuously learn are often the first considered for promotions and high level projects. Dedicating a small portion of a budget to self improvement can yield a high return on investment through increased earning potential.

Comparing Lifestyles on Social Media

Attempting to match the curated spending habits of peers leads to unnecessary debt and financial dissatisfaction. Social media often displays a distorted reality of luxury that may be funded entirely by credit cards. Focusing on personal financial goals rather than external appearances ensures long term stability and genuine satisfaction. Cultivating a mindset of gratitude and frugality allows for the accumulation of real wealth rather than the appearance of it.

Not Having a Written Budget

Operating without a formal plan for income and expenses leads to disorganized finances and missed opportunities. A written budget serves as a roadmap for achieving short term needs and long term aspirations. This tool helps prioritize essential costs like utilities and groceries while allocating specific amounts for savings and fun. Reviewing and updating the budget monthly ensures that financial goals remain on track despite changing life circumstances.

Ignoring High Interest Debt

Prioritizing low interest savings accounts while carrying high interest debt is a common mathematical error. The interest charged on credit cards is almost always higher than the interest earned in a standard savings vehicle. Focusing on an aggressive debt payoff strategy saves more money over time than keeping cash in a low yield account. Once high interest obligations are cleared more capital can be directed toward building wealth and investing for the future.

Buying Instead of Renting Too Early

Purchasing a home before being ready for the maintenance costs and lack of mobility can be a costly mistake. Homeownership involves many hidden expenses such as property taxes and emergency repairs that do not apply to renters. Being tied to a specific location may also limit career opportunities that require relocating for a higher salary. Renting provides the flexibility to explore different neighborhoods and careers while saving for a substantial down payment.

Carrying Excessive Student Debt

Taking on more student debt than the expected starting salary of a chosen profession can lead to years of financial struggle. Prospective students should research the average earnings for their field and choose institutions that offer a high value for the tuition cost. Overborrowing restricts the ability to save for a home or start a family shortly after graduation. Balancing education quality with affordability is key to ensuring that a degree remains a profitable investment.

Not Protecting Digital Assets

Failing to use strong passwords or two factor authentication leaves financial accounts vulnerable to cybercriminals. Identity theft can result in drained bank accounts and a destroyed credit history that takes years to repair. Regularly monitoring credit reports and using secure networks for financial transactions are necessary precautions in the digital age. Investing in a reputable password manager and staying informed about common scams protects hard earned money from fraud.

Failing to Set Financial Goals

Wandering through the twenties without specific objectives often leads to aimless spending and missed milestones. Setting clear targets for savings and debt reduction provides the motivation needed to stay disciplined with a budget. Goals should be measurable and time bound to allow for regular progress checks and adjustments. Having a vision for the future makes it easier to say no to impulsive purchases that do not align with long term plans.

Withdrawing Retirement Funds Early

Taking a distribution from a 401k or IRA before retirement age results in heavy taxes and early withdrawal penalties. This action also removes the funds from the market and halts the growth of compounding interest. Many people use these funds for down payments or weddings without considering the long term impact on their retirement security. It is almost always better to leave retirement accounts untouched and find alternative ways to fund large life events.

Not Shopping for Insurance Rates

Sticking with the same insurance provider for years without comparing rates often leads to paying more than necessary. Insurance markets change frequently and new discounts may become available based on age or driving record. Taking a few hours each year to get quotes from multiple companies can save hundreds of dollars on auto and renters insurance. Bundling different types of policies with a single provider can also result in significant cost reductions.

Overlooking Small Expenses

Frequent trips to convenience stores or paying for premium parking may seem insignificant but can total a large sum over time. These leaks in a budget are often the reason why people feel they have no money left at the end of the month. Packing a lunch or using public transportation are simple changes that can save a substantial amount of cash. Being mindful of every dollar spent helps build the discipline required for managing larger sums of money later in life.

Relying on a Single Income Stream

Depending entirely on one employer for financial stability carries significant risk in an unpredictable economy. Developing a side hustle or freelance business provides an additional layer of security and increases total earning potential. Diversified income streams can help accelerate debt payoff and provide a buffer during periods of unemployment. Exploring passive income opportunities also allows for wealth building that is not directly tied to hours worked.

Not Talking About Money With Partners

Avoiding financial discussions with a significant other can lead to major conflicts and incompatible lifestyle expectations. It is important to understand a partner’s debt levels and spending habits before making long term commitments. Open communication about goals and budgeting ensures that both individuals are working toward a shared vision. Establishing a system for managing joint expenses and individual savings promotes a healthy and transparent relationship.

Failing to Diversify Investments

Putting all available capital into a single stock or asset class exposes the investor to unnecessary volatility. A downturn in one sector could result in the loss of a significant portion of a portfolio if it is not properly diversified. Spreading investments across different industries and geographic regions helps mitigate risk and stabilize returns. Utilizing low cost index funds is an efficient way to achieve broad market exposure without the need for constant management.

Paying for Unused Gym Memberships

Maintaining a monthly gym contract without attending regularly is a common source of wasted funds. Many people sign up with good intentions during the new year but fail to make it a consistent habit. Canceling the membership and opting for outdoor activities or home workouts can save a significant monthly expense. If a gym is necessary choosing a pay as you go option or a more affordable facility can help keep costs under control.

Not Understanding Tax Deductions

Failing to take advantage of available tax credits and deductions can result in paying more in taxes than required. Understanding which expenses are deductible such as student loan interest or certain home office costs can lower the total tax bill. Many young professionals miss out on these savings simply because they do not research the tax code or use professional software. Keeping organized records throughout the year makes the filing process easier and ensures all eligible breaks are claimed.

Buying Cheap Products Repeatedly

Purchasing low quality items that need frequent replacement often costs more in the long run than investing in high quality goods. This concept applies to everything from kitchen appliances to professional clothing and footwear. A durable pair of shoes may cost more upfront but will last much longer than several cheap pairs. Practicing intentional consumption and prioritizing quality over quantity leads to better value and less waste over time.

Ignoring Credit Reports

Failing to check credit reports regularly means that errors or fraudulent activity may go unnoticed for a long time. These inaccuracies can lower a credit score and make it difficult to get approved for loans or rental agreements. Everyone is entitled to free annual reports from the major credit bureaus to ensure their information is correct. Monitoring these documents allows for quick resolution of any issues and helps maintain a healthy financial profile.

Overextending on Travel

Taking expensive vacations funded by credit cards can lead to months or years of debt repayment. While travel is an enriching experience it should be planned for and saved for in advance within a budget. Many young people feel pressured to take elaborate trips to match the lifestyles of those they see online. Finding affordable ways to explore and prioritizing local destinations can provide great experiences without compromising financial stability.

Not Automating Savings

Relying on willpower to move money into a savings account each month is often an ineffective strategy. Automating a portion of each paycheck to go directly into savings ensures that the goal is met before the money can be spent. This pay yourself first approach removes the temptation to use extra funds for discretionary purchases. Most banks and employers offer easy tools to set up these recurring transfers to various accounts.

Carrying Too Much Cash

Keeping large amounts of physical cash can lead to untracked spending and the risk of loss or theft. Cash does not earn interest and is not protected by the same security features as bank accounts. Transitioning to digital payments makes it easier to monitor transactions and maintain an accurate budget. Using a debit or credit card for most purchases also provides a clear paper trail for tax purposes and expense tracking.

Ignoring Inflation Impacts

Failing to account for the rising cost of living can result in a decrease in purchasing power over time. Savings held in low interest accounts may actually lose value if the inflation rate exceeds the interest earned. Investing in assets that historically outpace inflation such as stocks or real estate is necessary for long term wealth preservation. Keeping a pulse on economic trends helps in adjusting budgets and investment strategies to maintain financial health.

Not Having a Will or Basic Estate Plan

Many young adults assume they do not need an estate plan because they do not have significant assets yet. However having a basic will and healthcare proxy ensures that personal wishes are respected in the event of an emergency. This planning also makes the process much easier for family members who would otherwise have to navigate legal complexities. Establishing these documents early in life is a responsible step that provides clarity and protection for loved ones.

Overpaying for Name Brands

Choosing premium brands for household staples and groceries can significantly increase a monthly food budget without a corresponding increase in quality. Generic or store brand products often contain the same ingredients as their expensive counterparts for a fraction of the price. Switching to these alternatives allows for substantial savings that can be redirected toward debt repayment or investments. Smart shopping and price comparison are essential skills for staying within a modest budget.

Using Retirement for House Down Payments

Withdrawing from a 401k or IRA to fund a home purchase can severely diminish the total value of the account at retirement age. While some plans allow for penalty free withdrawals for first time buyers the opportunity cost of lost growth is often too high. It is generally better to save for a down payment in a dedicated high yield savings or brokerage account. Keeping retirement funds invested allows them to benefit from long term market appreciation.

Not Learning to Cook at Home

Relying on takeout and restaurant meals is one of the fastest ways to drain a monthly budget in your twenties. Cooking at home is significantly cheaper and often healthier than eating out several times a week. Meal prepping for the work week prevents the need for expensive convenience foods and reduces food waste. Developing basic culinary skills is a lifelong asset that supports both financial health and physical well being.

Falling for Get Rich Quick Schemes

Investing in unproven ventures or multilevel marketing programs often leads to the loss of both time and money. These opportunities usually promise high returns with minimal effort which is a common red flag for fraud. Building wealth is typically a slow and steady process involving consistent saving and prudent investing over many years. Focusing on established financial principles and career growth is a more reliable path to economic success.

Not Seeking Professional Advice

Trying to handle complex financial situations alone can lead to costly mistakes and missed opportunities. Consulting with a certified financial planner or tax professional can provide valuable insights tailored to specific goals. These experts can help optimize investment portfolios and create tax efficient strategies that save money over the long term. Investing in professional guidance is often worth the cost for the clarity and confidence it provides.

Neglecting Maintenance Tasks

Ignoring routine maintenance on a car or home can lead to much larger and more expensive repairs down the road. Small tasks like changing the oil in a vehicle or cleaning gutters prevent major systems from failing prematurely. Staying on top of these responsibilities preserves the value of assets and prevents sudden financial shocks. Budgeting for regular maintenance ensures that these costs are covered without needing to use emergency funds.

Living Without Renters Insurance

Assuming a landlord’s insurance covers personal belongings is a common and expensive mistake for many renters. Renters insurance is typically very affordable and provides coverage for theft or damage caused by fire or water. It also offers liability protection if someone is injured while visiting the apartment. Having a policy in place provides essential financial protection for relatively little cost each month.

Overlooking Credit Card Rewards

Failing to utilize the points or cashback offered by credit cards means missing out on free money for regular spending. Many cards offer significant bonuses for categories like groceries gas or travel that can add up over a year. Using these rewards responsibly to cover travel costs or reduce a balance is a smart financial move. It is important to choose a card that aligns with common spending habits to maximize the potential benefits.

Not Reviewing Insurance Deductibles

Keeping a low deductible on insurance policies often results in unnecessarily high monthly premiums. If an individual has a healthy emergency fund they can often afford to raise their deductible in exchange for lower monthly costs. This adjustment can save a significant amount of money over several years of claim free driving or homeownership. Evaluating these levels annually ensures that the balance between premium costs and out of pocket risk is appropriate.

Failing to Negotiate Bills

Many people accept the initial price offered for internet cable or phone services without ever asking for a better rate. Service providers often have promotional pricing available for customers who call and express an interest in canceling. Spending a few minutes on the phone each year can result in hundreds of dollars in savings on recurring household bills. Being a polite and persistent negotiator is a simple way to keep monthly overhead as low as possible.

Not Celebrating Small Wins

Failing to acknowledge progress toward financial goals can lead to burnout and a lack of motivation. While discipline is important it is also necessary to reward yourself in small ways when milestones are achieved. This could be a modest dinner out or a small purchase that fits within the overall budget plan. Recognizing success reinforces positive habits and makes the long term journey toward financial freedom more enjoyable.

Share your own experiences and tips for avoiding financial mistakes in the comments.