The digital asset landscape has grown from a niche experiment into a global financial sector involving millions of participants and trillions in market value. Despite this rapid expansion, a significant number of misconceptions continue to circulate among potential investors and the general public. Many of these stories stem from early associations with unregulated markets or a misunderstanding of the underlying distributed ledger technology. Separating these common myths from the operational realities of the industry is essential for anyone looking to navigate the modern economy. This guide examines forty of the most persistent falsehoods to provide a clearer picture of how digital currencies actually function in the current year.

Cryptocurrency Is Only For Criminals

A persistent narrative suggests that digital assets are primarily used for money laundering and illicit transactions on the dark web. While early adoption did include some unregulated markets, data from blockchain analytics firms shows that illicit activity accounts for less than one percent of total transaction volume. Most participants use these assets for legitimate investment, remittances, and decentralized finance applications. Law enforcement agencies also have sophisticated tools to track and seize funds on transparent public ledgers.

Transactions Are Completely Anonymous

Many people believe that using a digital wallet allows for total secrecy and invisibility from government authorities. In reality, most major blockchains are public ledgers where every transaction is recorded permanently and can be viewed by anyone with an internet connection. While personal names are not directly attached to wallet addresses, these addresses can be linked to real identities through service providers. Regulated exchanges now require strict identification protocols that mirror traditional banking standards.

Bitcoin and Blockchain Are The Same

It is a common mistake to use these two terms interchangeably as if they represent the exact same concept. Bitcoin is a specific type of digital currency that serves as a medium of exchange or a store of value. Blockchain is the foundational technology that allows for a decentralized record of data without a central authority. This technology has vast applications beyond currency, including supply chain management, voting systems, and secure medical record sharing.

Digital Assets Have No Intrinsic Value

Critics often claim that because these assets are not physical or backed by gold, they have no real worth. Value in the digital age is frequently derived from utility, scarcity, and the security of the underlying network. Many protocols provide essential services like automated smart contracts or borderless payments that traditional systems cannot match. The market value reflects the collective trust in these functions and the mathematical certainty of limited supply.

The Entire Market Is A Bubble

The dramatic price swings seen in the news often lead observers to label the entire industry as a temporary speculative mania. While individual tokens may experience rapid inflation and crashes, the sector has survived multiple cycles over nearly two decades. Each recovery has been accompanied by increased institutional adoption and more robust infrastructure. Comparing the entire technology to a bubble ignores the long-term growth of the decentralized ecosystem.

It Is Too Late To Invest

Prospective participants often feel they missed the opportunity to join because prices are much higher than they were a decade ago. This perspective assumes that the technology has reached its full potential and maximum adoption. The current infrastructure is actually more stable and accessible than in previous years. Many analysts view the current stage as the early adoption phase for mainstream institutional and retail utility.

You Must Buy A Full Coin

A major barrier to entry for many is the belief that one must purchase an entire unit of an expensive asset like Bitcoin. Most digital currencies are divisible into very small fractions, allowing for purchases of any amount. For example, a single Bitcoin can be divided into one hundred million smaller units known as satoshis. This makes it possible for individuals to start with a very small amount of capital.

Blockchains Are Easily Hacked

Frequent news reports about exchange thefts lead to the misconception that the underlying blockchain technology is insecure. Most high-profile losses occur due to vulnerabilities in third-party platforms or poor personal security habits. The core networks of major assets use massive amounts of computing power to remain resistant to attacks. A successful breach of a large decentralized network would require a level of resources that is currently considered unfeasible.

Cryptocurrency Is Bad For The Environment

Concerns about the energy consumption of mining have led to the myth that all digital assets are ecological disasters. Many newer networks use a validation method called proof of stake, which reduces energy consumption by over ninety-nine percent. Even for networks that require more power, a significant portion of mining operations now utilize stranded renewable energy sources. Some studies suggest that the industry is actually driving innovation in sustainable energy infrastructure.

Governments Will Soon Ban Crypto

The idea that a single government can simply turn off a decentralized network is a common misunderstanding of how the technology works. While some countries have attempted to restrict certain activities, many others are creating formal regulatory frameworks to integrate these assets. Total bans are difficult to enforce across borders and often result in activity moving to more friendly jurisdictions. Most major economies are now focusing on taxation and consumer protection rather than prohibition.

All Tokens Are The Same

Beginners often treat all digital assets as if they share the same purpose and risk profile. There are actually several distinct categories, including stablecoins, governance tokens, and utility tokens. Each serves a different function within its specific ecosystem, ranging from tracking the price of the dollar to granting voting rights. Understanding these differences is vital because the performance of one category does not guarantee the success of another.

Only Tech Experts Can Use It

There is a lingering belief that managing digital assets requires advanced coding skills or deep technical knowledge. Modern user interfaces for wallets and exchanges have become as intuitive as standard banking applications. Most users interact with the technology through simple apps that handle the complex cryptography in the background. While basic security awareness is necessary, professional technical training is not a requirement for participation.

It Will Replace All Physical Money

Some enthusiasts claim that traditional fiat currency is on the verge of total disappearance in favor of digital tokens. Most experts believe the future involves a hybrid system where both forms of currency coexist and complement each other. Central banks are even developing their own digital versions of national currencies to bridge the gap. Digital assets are more likely to serve as an alternative layer for global finance rather than a total replacement for cash.

Transactions Are Too Slow For Daily Use

Early issues with network congestion created the myth that sending digital assets always takes hours. New developments like layer-two scaling solutions allow for nearly instantaneous transactions with very low fees. These innovations enable the technology to compete with the speed of traditional credit card networks. Many merchants now accept these rapid payments for everyday items like coffee or clothing.

Crypto Is A Get Rich Quick Scheme

Social media influencers often promote the idea that anyone can become a millionaire overnight with a small investment. While some individuals have seen massive returns, these outcomes are often the result of high risk or extreme luck. Like any other financial market, sustainable success usually requires patience, research, and a long-term strategy. Treating it as a shortcut to wealth often leads to significant financial losses for unprepared participants.

Stablecoins Are Always Safe

The name stablecoin implies that these assets will always maintain a steady value of one dollar. While many are backed by cash reserves, some rely on complex algorithms that can fail during market stress. Users should understand that the stability of these tokens depends entirely on the transparency and reliability of the issuing entity. Not all stablecoins are created equal, and some carry more risk than others.

Smart Contracts Are Legally Binding

There is a misconception that a piece of code automatically holds the same weight as a traditional legal contract. A smart contract is simply a set of instructions that executes automatically when certain digital conditions are met. While they are highly efficient for technical tasks, they do not always account for the nuances of local laws. Legal systems are still catching up to determine how these digital agreements interface with existing regulations.

You Do Not Have To Pay Taxes

Some people believe that because transactions are decentralized, they are exempt from national tax obligations. Most tax authorities now view digital assets as property or capital gains, meaning every trade or sale is a taxable event. Exchanges in many jurisdictions are required to report user activity directly to the government. Failing to track and report these gains can lead to significant legal and financial penalties.

The CEO of Bitcoin Controls Everything

Newcomers often look for a central leader or company to hold accountable for the performance of the network. Bitcoin was designed to be leaderless and is maintained by a global community of independent developers and miners. No single person or entity has the power to change the rules of the network without a broad consensus. This decentralization is a core feature that prevents any one individual from exerting total control.

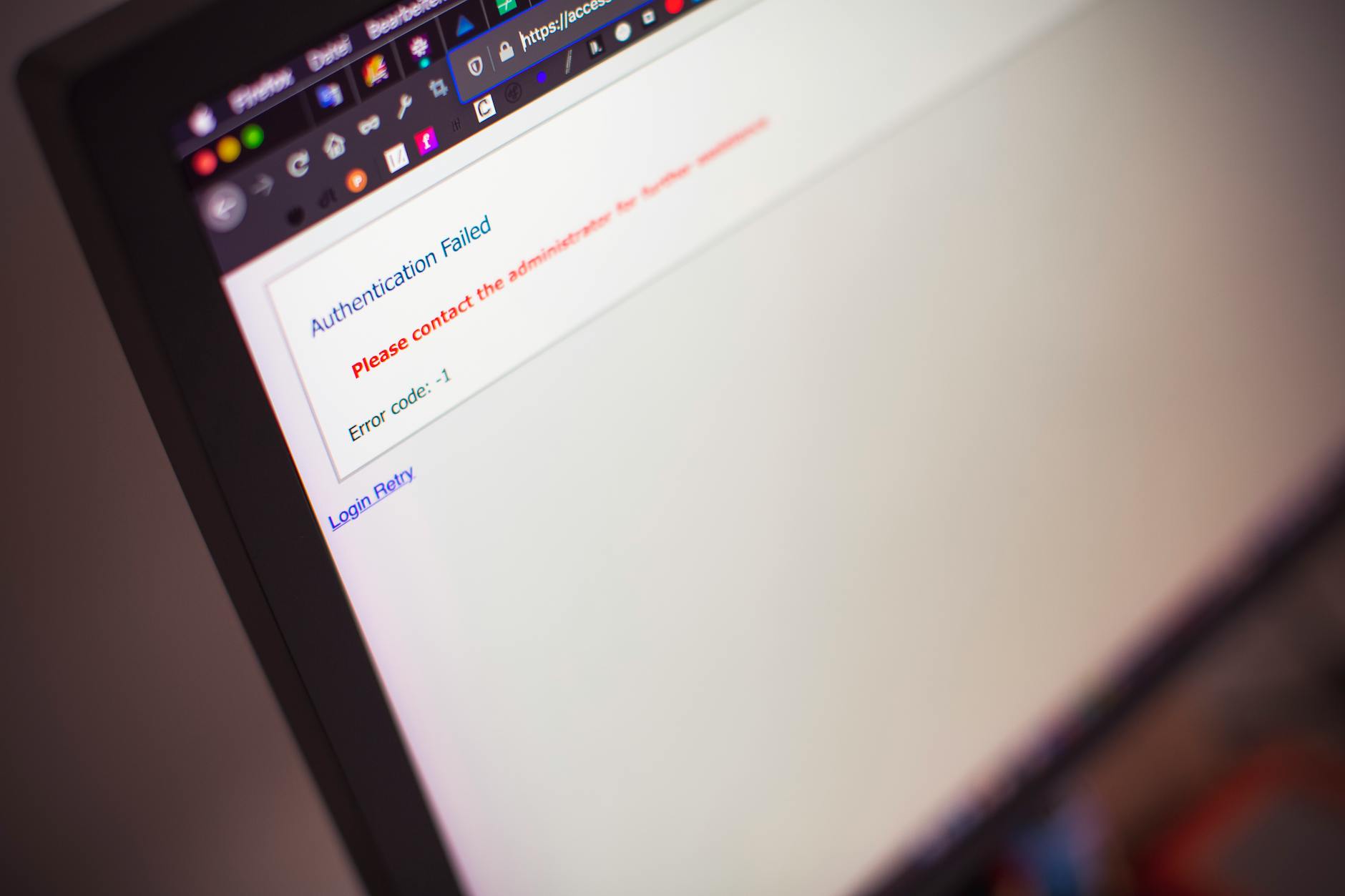

Lost Coins Can Be Recovered

A common myth is that there is a customer support department that can help you if you lose access to your wallet. In a decentralized system, the user is solely responsible for their private keys and recovery phrases. If these are lost or stolen, there is no central authority with a master key to restore the account. This high level of personal responsibility is a fundamental aspect of owning digital assets.

Prices Are Only Driven By Hype

While social media trends can cause short-term volatility, the long-term value is increasingly tied to actual usage. Projects that provide real utility in areas like decentralized lending or insurance are seeing growth independent of viral memes. Institutional investors now use sophisticated fundamental analysis to determine which assets to hold. As the market matures, the influence of pure hype is gradually being replaced by economic reality.

It Is Primarily Used For Speculation

The focus on price charts often hides the fact that millions of people use digital assets for practical purposes every day. In regions with unstable local currencies, people use digital assets to preserve their savings and purchasing power. It also provides a vital lifeline for migrant workers to send money home without paying high traditional fees. These real-world applications are a growing part of the ecosystem that goes beyond simple trading.

Quantum Computers Will Kill Crypto

There is a fear that the arrival of quantum computing will instantly break the encryption used by blockchains. While quantum computers pose a theoretical threat, the industry is already developing quantum-resistant algorithms. Most major networks can be upgraded to more secure cryptographic standards through a consensus process. The transition to new security models is expected to occur well before quantum technology becomes a practical threat.

Private Keys Are The Same As Passwords

Many users mistakenly treat their private keys like a standard website password that can be reset via email. A private key is a long string of characters that acts as the ultimate mathematical proof of ownership. If someone else obtains your private key, they have total and permanent control over your assets. Unlike a password, a private key cannot be changed or recovered if the original is compromised.

All Mining Is Wasted Energy

The term mining often leads to the belief that the energy used is purely for the creation of new tokens. The primary purpose of mining is actually to secure the network and validate every transaction that occurs. This energy consumption replaces the massive infrastructure of traditional banks, including physical buildings, armored cars, and global data centers. When compared to the entire traditional financial system, the energy use of digital networks provides a different level of efficiency.

Only Small Companies Accept Crypto

A lingering myth is that only niche websites or small tech shops accept digital assets as payment. Major global corporations in the retail, travel, and luxury sectors have integrated digital payment options. Some of the largest payment processors in the world now allow their millions of merchants to settle transactions in various tokens. This mainstream acceptance is steadily turning digital assets into a common method for purchasing high-value goods.

It Is A Ponzi Scheme

Skeptics often compare the entire industry to a fraudulent scheme where old investors are paid with new investors’ money. A Ponzi scheme requires a central organizer who deceives participants about where the profits come from. Decentralized networks are transparent and operate based on open-source code that anyone can audit. The value fluctuations are a result of supply and demand in an open market rather than a structured fraud.

You Need A Special Computer To Start

People often see photos of massive mining warehouses and think they need similar equipment to participate. Buying and holding digital assets only requires a standard smartphone or a basic laptop with an internet connection. Professional mining hardware is only necessary for those who want to compete in the validation process of certain networks. For the average user, the barriers to entry are no different than using a social media account.

Inflation Does Not Affect Crypto

A common belief is that all digital assets are naturally resistant to the rising costs of living. While some assets have a fixed supply that makes them deflationary, others have infinite supplies or high annual inflation rates. The specific monetary policy of each token determines how it reacts to broader economic shifts. Investors must research the specific tokenomics of an asset rather than assuming it is a universal hedge against inflation.

Decentralization Means No Rules

Some participants believe that the lack of a central authority means there are no consequences for bad behavior. While the network itself is neutral, the people and businesses using it are still subject to the laws of their physical location. Regulators are increasingly active in monitoring the space to prevent fraud and protect consumers. Decentralization provides technical freedom, but it does not grant legal immunity in the real world.

Hardware Wallets Are Unbreakable

There is a myth that as long as you use a physical hardware wallet, your funds are completely immune to any threat. While these devices are much safer than keeping funds on an exchange, they do not protect against human error or social engineering. If a user is tricked into revealing their recovery phrase, the hardware wallet cannot prevent the theft. Physical security and cautious behavior remain essential even when using the most advanced hardware.

It Is Only For Young People

The image of the young, tech-savvy trader has led many older individuals to believe the technology is not for them. Demographic data shows that participants from all age groups are increasingly entering the market as a way to diversify their portfolios. Financial advisors for all generations are beginning to include digital assets in retirement and long-term wealth strategies. The growing simplicity of the technology is making it accessible to anyone comfortable with digital banking.

Every New Project Is A Scam

Because there have been high-profile frauds, some people dismiss every new development in the space as a trap. While caution is necessary, many new projects are built by reputable teams and backed by established venture capital firms. Legitimate projects typically have public audits of their code and transparent whitepapers explaining their utility. Learning how to distinguish between a verified project and a suspicious one is a key skill for modern participants.

You Can Only Make Money In A Bull Market

The popular belief is that the only way to profit is to buy low and sell during a massive price surge. Advanced participants use various strategies to earn returns even when prices are falling or staying flat. This includes activities like staking, where users earn rewards for helping to secure a network. Decentralized finance also offers opportunities to earn interest on holdings similar to a traditional savings account.

Crypto Will Crash To Zero

Critics have predicted the total collapse of the digital asset market hundreds of times over the last decade. While individual tokens can and do fail, the underlying technology has become too integrated into the global economy to simply disappear. Major financial institutions now offer digital asset products to their clients, providing a level of stability that did not exist in the early years. The network effect of millions of users and developers makes a total disappearance highly unlikely.

Exchanges Are The Same As Banks

Many users treat their accounts on centralized exchanges as if they were traditional bank accounts with the same protections. Unlike banks, many exchanges do not have government-backed insurance to cover losses in the event of a failure. If an exchange goes bankrupt or is hacked, users may have very little recourse to get their funds back. The safest way to hold assets is often in a private wallet where the user controls the keys.

It Is A Form Of Gambling

The high volatility leads many to categorize digital assets as a game of chance rather than an investment. While short-term trading of unknown tokens can be risky, long-term holding of established assets is often based on fundamental research. Professional investors treat the sector as a new asset class with its own unique risks and rewards. Viewing it as an investment requires a different mindset and risk management strategy than traditional gambling.

The Government Can Edit The Blockchain

A common concern is that authorities could force a network to change a transaction or delete a wallet. The decentralized nature of a public blockchain means that no single government has the authority to alter the history of the ledger. To make a change, a government would need to control more than half of the entire global network’s computing power. This technical independence is one of the primary reasons many people value the technology.

Crypto Is Just A Digital Version Of Cash

While they share some similarities, digital assets offer many functions that physical cash can never replicate. Digital tokens can be programmed with specific rules, such as releasing funds only when a certain date is reached or a task is completed. They also allow for the ownership of fractional pieces of real-world assets like real estate or art. These programmable features make the technology a far more complex tool than simple digital money.

You Can Predict The Market With Charts

Many traders believe that by looking at past price patterns, they can accurately predict future movements every time. While technical analysis can provide some insights, the market is influenced by unpredictable global news and regulatory changes. No chart can account for a sudden shift in government policy or a major technological breakthrough. Relying solely on patterns without considering broader context is a common mistake that leads to unexpected results.

Please share your thoughts on these common digital asset myths in the comments.