The process of reclaiming financial freedom requires a strategic blend of disciplined spending and aggressive repayment methods tailored to individual budgets. Prioritizing high-interest balances helps reduce the total amount of interest paid over the lifespan of various loans. Many successful individuals find that small behavioral shifts combined with structured payment plans accelerate the journey toward a zero balance. Consistently applying these techniques ensures a steady decline in total liabilities while building long-term fiscal resilience.

Debt Snowball Method

This strategy focuses on paying off the smallest individual balances first while maintaining minimum payments on all other accounts. Eliminating smaller debts quickly provides psychological momentum and a sense of accomplishment that encourages continued progress. As each small balance disappears the money previously allocated to it gets rolled into the payment for the next smallest debt. This creates a powerful compounding effect that allows larger balances to be tackled with much greater financial force.

Debt Avalanche Method

The avalanche approach prioritizes accounts with the highest interest rates regardless of the total balance size. By targeting the most expensive debt first this method minimizes the total amount of interest accrued over time. Once the highest interest loan is fully satisfied the entire payment amount is redirected toward the debt with the next highest rate. This mathematically efficient system saves the most money in the long run and shortens the overall repayment period.

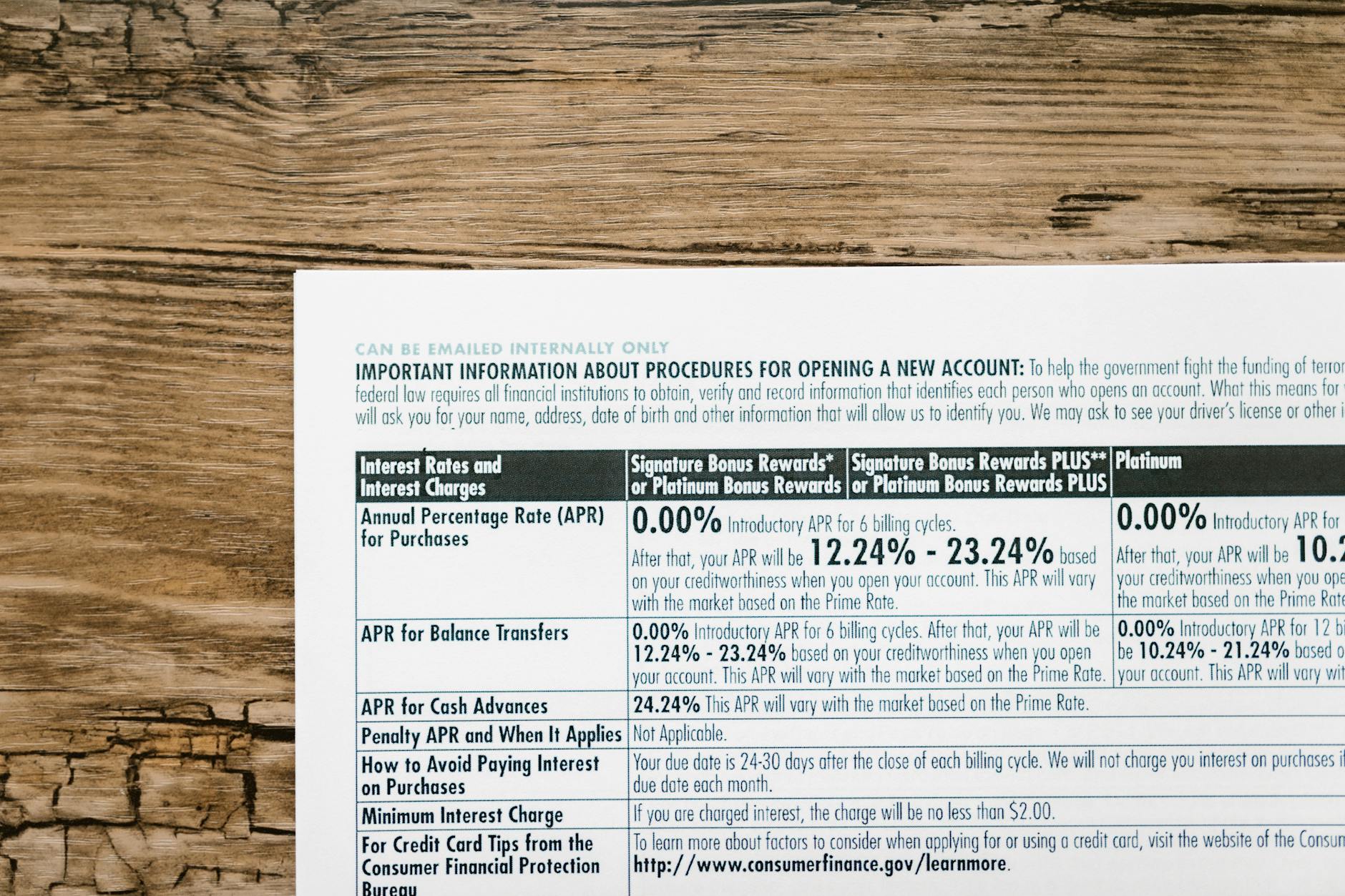

Credit Card Balance Transfers

Moving high-interest credit card debt to a new card with a zero percent introductory rate can provide significant temporary relief. This tactic allows the entire monthly payment to go directly toward the principal balance rather than being consumed by interest charges. Most introductory offers last between twelve and twenty-one months giving the borrower a dedicated window for aggressive repayment. It is essential to pay off the transferred amount before the promotional period ends to avoid new high interest rates.

Personal Consolidation Loans

Consolidating multiple high-interest debts into a single personal loan often results in a lower overall interest rate and one predictable monthly payment. This simplifies the repayment process by replacing various due dates and different interest structures with a fixed term. Fixed interest rates protect the borrower from market fluctuations that might otherwise increase the cost of credit card debt. A successful consolidation requires a commitment to stop using the original credit lines while the new loan is being repaid.

Zero Based Budgeting

Assigning every single dollar of income to a specific category or debt payment ensures that no money is wasted on unplanned expenses. This meticulous tracking method forces an awareness of where funds are going and identifies surplus cash that can be applied to balances. By creating a budget where income minus expenses equals zero the borrower maintains total control over their financial flow. Regular adjustments to the budget allow for flexibility as debt levels decrease and financial goals evolve.

Automated Payments

Setting up recurring transfers from a checking account ensures that every debt payment is made on time without the risk of late fees. Automation removes the emotional friction associated with manually sending large sums of money toward past purchases. Many lenders offer a small interest rate reduction for customers who enroll in automatic drafting programs. Consistent on-time payments also contribute positively to a credit score during the repayment process.

The Snowflake Method

This technique involves making tiny immediate payments toward debt whenever small amounts of unexpected cash are received. Examples include a five dollar rebate or twenty dollars found in a pocket being immediately applied to a credit balance. These micro payments prevent small windfalls from being spent on non-essential items and reduce the principal balance incrementally. Over the course of a month these frequent small contributions can significantly impact the total interest charged.

Cash Envelope System

Using physical cash for daily spending categories like groceries and entertainment prevents the accumulation of new revolving debt. Once the cash in a specific envelope is gone for the month no further spending can occur in that category. This tactile method of money management forces a direct confrontation with the reality of limited resources. It eliminates the temptation to swipe a credit card for impulsive purchases that would derail a payoff plan.

Debt Management Plans

Enrolling in a structured plan through a non-profit credit counseling agency can lead to negotiated lower interest rates with creditors. These agencies work directly with lenders to create a consolidated payment schedule that typically lasts three to five years. The borrower makes one monthly payment to the agency which then distributes the funds to the various creditors. This professional intervention can provide a clear path forward for those struggling with overwhelming high-interest balances.

Lifestyle Deflation

Temporarily reducing discretionary spending to the absolute minimum creates a larger gap between income and expenses for debt repayment. This might include cancelling unused subscriptions or choosing home-cooked meals over dining out for a set period. Every dollar saved through these sacrifices is immediately redirected toward the highest priority debt balance. The intensity of this lifestyle shift is often balanced by the speed at which the debt is eliminated.

HELOC Debt Consolidation

Homeowners may choose to use a home equity line of credit to pay off high-interest consumer debt at a much lower rate. This strategy utilizes the equity built in a property to secure a more favorable interest environment for repayment. While it can lower monthly costs significantly it does involve moving unsecured debt into a debt secured by a primary residence. Disciplined repayment is vital to ensure the home remains protected while the debt is being cleared.

Retirement Loan Options

Some individuals choose to take a loan from their 401k or employer-sponsored retirement plan to settle high-interest liabilities. The interest paid on these loans is typically returned to the individual’s own retirement account rather than a banking institution. This can be an effective way to stop the bleed of high-interest credit cards while keeping the money within one’s own financial ecosystem. Caution is required as leaving an employer may trigger an immediate requirement to repay the full loan balance.

Student Loan Refinancing

Replacing existing student loans with a new private loan can secure a lower interest rate for those with improved credit scores. Lowering the rate by even a small percentage can save thousands of dollars over the life of the loan. This process often allows for the consolidation of multiple federal and private loans into a single manageable payment. It is important to note that refinancing federal loans into private ones may result in the loss of certain government protections.

Selling Unused Assets

Generating a quick influx of cash by selling items like electronics or furniture can provide a significant boost to a debt payoff goal. These one-time lump sums are most effective when applied directly to the principal of the smallest or highest-interest debt. Online marketplaces and local consignment shops provide accessible platforms for converting clutter into capital. Clearing physical space often mirrors the mental clarity gained from reducing financial burdens.

Skill Based Side Hustles

Utilizing professional skills outside of primary employment hours can generate dedicated income specifically for debt repayment. Whether through freelance writing or consulting these additional funds are treated as extra payments rather than general spending money. Keeping this secondary income separate from the main budget ensures that every extra hour worked directly impacts the debt balance. As the debt decreases the need for the side hustle may also diminish.

Cash Back Redemption

Redeeming accumulated rewards or cash back from existing credit cards can be a subtle but effective way to chip away at balances. Instead of using points for travel or gift cards applying them as a statement credit directly reduces the amount owed. This method utilizes money that has already been spent to help pay for the debt itself. It is a simple administrative task that can be performed monthly to provide small wins.

Utility Audit

Reviewing monthly recurring bills for services like internet or insurance can reveal opportunities for significant savings. Negotiating lower rates with current providers or switching to competitors can free up monthly cash flow for debt payments. Many service providers offer loyalty discounts or lower-tier plans that still meet basic needs. These permanent reductions in overhead provide long-term benefits for the entire financial plan.

Tax Refund Allocation

Directing an entire annual tax refund toward a debt balance can eliminate months of interest and principal in a single day. While it may be tempting to use a refund for a vacation applying it to debt is a high-impact financial move. This large lump sum can often finish off a specific account or significantly lower a high-interest balance. Treating the refund as found money for the debt goal keeps the focus on long-term freedom.

Negotiating Interest Rates

Calling creditors directly to request a lower interest rate can sometimes result in immediate savings without the need for a balance transfer. A history of on-time payments and a good relationship with the lender increases the likelihood of a successful negotiation. Even a two percent reduction in the annual percentage rate can change the trajectory of the repayment timeline. This simple conversation costs nothing and can yield substantial financial benefits.

Renting Extra Space

Homeowners can generate consistent monthly income by renting out a spare room or a storage area like a garage. This passive income stream can be funneled entirely into a debt repayment plan to accelerate the process. Using a dedicated platform to find vetted renters ensures a level of security and professional management. The additional monthly revenue can often cover a significant portion of a minimum payment or principal reduction.

Temporary Second Job

Taking on a part-time position in retail or service industries provides a guaranteed increase in monthly cash flow for a set time. This strategy is often used for a short duration to knock out a specific high-interest credit card or medical bill. Because the income is predictable it can be budgeted accurately toward the debt payoff schedule. The physical labor involved often serves as a deterrent against returning to previous spending habits.

The Bonus Rule

Applying one hundred percent of work bonuses or performance incentives to debt prevents lifestyle creep from consuming extra earnings. Since these funds are not part of the base salary the household budget remains unaffected by their absence. This discipline turns professional success into financial freedom by rapidly decreasing total liabilities. It ensures that hard work in the office translates directly into a better personal balance sheet.

Public Service Loan Forgiveness

Employees in certain non-profit or government sectors may qualify for total student loan forgiveness after a specific period of service. This program requires making one hundred and twenty qualifying monthly payments while working for an eligible employer. Understanding the specific documentation and employment requirements is crucial for successfully navigating this path. For those who qualify it represents one of the most significant ways to eliminate large debt burdens.

Credit Score Monitoring

Regularly checking a credit report allows for the identification of errors that might be negatively impacting interest rates. Disputing inaccuracies can lead to a higher credit score which in turn opens doors to better refinancing options. A higher score demonstrates reliability to lenders and can be used as leverage when negotiating better terms. Monitoring progress also provides a visual representation of how debt reduction is improving financial health.

Cutting Insurance Costs

Shopping around for new homeowners or auto insurance policies every year can lead to surprising monthly savings. Many people overpay for coverage that no longer fits their specific needs or current asset values. Increasing deductibles on certain policies can also lower monthly premiums and free up cash for debt. The saved difference should be immediately added to the monthly debt payment to maintain the momentum.

Grocery Meal Planning

Creating a strict weekly meal plan based on pantry staples and sales prevents expensive impulse buys at the store. Reducing food waste and avoiding high-priced convenience items can save hundreds of dollars each month. This reclaimed money provides a consistent source of extra funds for the debt payoff strategy. Successful meal planning also reduces the temptation to order takeout during busy work weeks.

Subscription Purge

Auditing bank statements for forgotten or rarely used digital subscriptions can uncover hidden leaks in a budget. Deleting apps or services that charge small monthly fees adds up to a meaningful amount over a full year. These small savings are often the easiest to find and require the least amount of effort to implement. Redirecting these funds to a debt balance ensures the money is serving a productive purpose.

Generic Brand Preference

Choosing store brands for household staples and over-the-counter medications provides the same quality for a fraction of the cost. This habit change across all shopping categories results in significant cumulative savings. The price difference between name brands and generics can be twenty to forty percent on average. Over time these savings can be funneled into a dedicated debt repayment fund.

Energy Efficiency Habits

Lowering home energy costs through simple habits like adjusting the thermostat or using LED bulbs reduces monthly overhead. Unplugging electronics when not in use and washing clothes in cold water can further decrease utility bills. These small environmental choices lead to direct financial gains that support the overall debt goal. The savings may seem minor but they contribute to a culture of mindful resource management.

No Spend Challenges

Committing to a weekend or a full month of zero discretionary spending can provide an intense burst of debt repayment funds. These challenges focus on using only what is already in the house and avoiding all non-essential purchases. It serves as a financial reset that highlights the difference between wants and needs. The money saved during the challenge is then used to make a larger than normal payment on a balance.

Commute Optimization

Reducing transportation costs through carpooling or using public transit can free up significant portions of a monthly budget. Some individuals choose to sell a vehicle with a high payment in favor of a more affordable used option. Saving on fuel and maintenance provides immediate cash that can be applied to other outstanding loans. This shift often requires a change in daily routine but offers high financial rewards.

Thrift Store Shopping

Purchasing clothing and household items from secondary markets reduces the cost of necessary acquisitions. High-quality items can often be found for a small percentage of their original retail price. This approach prevents new debt from being used for lifestyle upgrades and keeps spending in check. It also promotes a more sustainable way of living while focusing on the primary goal of debt elimination.

Peer to Peer Lending

Using a peer-to-peer lending platform can sometimes offer more competitive interest rates than traditional banking institutions. These platforms connect individual investors with borrowers who need to consolidate or pay off debt. For those with solid credit this can be a viable alternative to high-interest credit cards. The application process is often streamlined and provides a clear fixed repayment schedule.

Interest Only Payment Strategies

In very specific high-interest scenarios paying only the interest on low-rate debt can free up more cash for high-rate debt. This is an advanced tactic used to maximize the impact of every dollar in an avalanche-style plan. Once the high-interest debt is gone the focus returns to the principal of the remaining loans. It requires a disciplined approach to ensure the principal eventually gets paid down.

Hardship Programs

Contacting lenders to inquire about temporary hardship programs can lead to deferred payments or reduced interest during financial crises. These programs are designed to help borrowers avoid default during unexpected life events like illness or job loss. While they are temporary they can provide the breathing room needed to stabilize a budget. It is important to communicate with creditors before a payment is actually missed.

Holiday Budgeting

Setting a strict cash limit for holiday spending prevents the common cycle of accruing new debt at the end of the year. Planning for these expenses months in advance ensures that gifts and celebrations do not interfere with repayment goals. Many people find that focusing on experiences or handmade gifts reduces the financial strain of the season. Keeping debt levels flat during the holidays is a major win for the overall plan.

Medical Bill Negotiation

Requesting an itemized bill for medical services can often reveal errors or overcharges that can be disputed. Many hospitals and clinics offer significant discounts for paying a lump sum or for those who demonstrate financial need. Setting up a zero-interest payment plan directly with the provider is usually better than putting the balance on a credit card. Professional medical bill advocates are also available to help navigate complex insurance and billing issues.

Library Resource Utilization

Using the local library for books and digital media eliminates the need for purchasing entertainment or educational materials. Many libraries also offer free access to expensive software or tools that would otherwise be a budget drain. This free resource allows for continued personal growth and recreation without any financial cost. Every book not bought is more money available for the debt payoff journey.

Birthday Cash Allocation

Redirecting monetary gifts from birthdays or anniversaries toward a debt balance can provide a helpful boost. While it may feel less celebratory than buying a treat the long-term benefit of reduced debt is a lasting gift. Family members may even be encouraged to contribute to a debt fund in lieu of physical presents if they know the goal. This transparency helps build a supportive community around the financial objective.

DIY Home Maintenance

Learning to perform simple home or car repairs through online tutorials saves on expensive labor costs. Tasks like changing a car’s oil or fixing a leaky faucet are manageable for many people with basic tools. The money saved by not hiring a professional can be used to make extra principal payments. This self-reliance also builds valuable skills that continue to save money in the future.

Refinancing Auto Loans

If credit scores have improved since a car was purchased it may be possible to refinance the auto loan at a lower rate. This can reduce the monthly payment amount or the total interest paid over the life of the loan. Some borrowers choose to keep the payment the same but use the lower rate to pay the car off faster. It is a relatively simple way to optimize a major monthly expense.

Employer Tuition Reimbursement

Many companies offer programs to pay back a portion of student loan debt or cover the cost of ongoing education. Utilizing these benefits is essentially receiving a tax-free raise that is applied directly to a liability. Employees should check their benefits package to see if they qualify for any form of educational assistance. This can shave years off the repayment timeline for student loans.

Selling a House or Downsizing

In extreme cases selling a home with significant equity and moving to a more affordable residence can wipe out all debt at once. This major life change provides a fresh start and significantly lowers monthly living expenses. The remaining equity can be used to pay off all consumer loans and provide a solid emergency fund. While it is a drastic step it is a highly effective way to achieve total financial freedom.

Debt Settlement

Negotiating with creditors to pay a lump sum that is less than the total amount owed can be a final resort for old debts. This typically occurs when a debt is significantly past due and the creditor wants to recover some portion of the balance. While it can impact credit scores it does settle the obligation for good. This method is often handled through professional settlement companies or through direct negotiation.

Avoiding Impulse Triggers

Identifying the emotional or environmental triggers that lead to unnecessary spending helps prevent new debt from forming. This might involve unsubscribing from retail emails or avoiding shopping malls as a form of entertainment. Building awareness of these habits protects the progress made in the repayment plan. A stable debt-free future depends on permanent changes to spending behavior.

Windfall Planning

Creating a plan for how to handle any unexpected money before it arrives prevents it from being wasted. Whether it is an inheritance or a small lottery win having a predetermined allocation for debt ensures the money is used wisely. This proactive approach turns surprises into strategic opportunities for financial advancement. It reinforces the commitment to the primary goal of becoming debt-free.

Consolidation of Federal Loans

Combining multiple federal student loans into a single Direct Consolidation Loan can simplify repayment and provide access to different plans. This does not always lower the interest rate but it can make the debt eligible for forgiveness programs. Having one payment and one servicer reduces the administrative burden of managing student debt. It is a foundational step for many who are tackling large educational balances.

Peer Accountability

Sharing debt payoff goals with a trusted friend or family member can provide the encouragement needed to stay on track. Regular check-ins or sharing progress milestones creates a sense of accountability that prevents backsliding. Some people find success in online communities where others are working toward similar financial goals. Knowing that others are watching can be a powerful motivator during the long middle phase of the journey.

Share your favorite debt payoff tips or success stories in the comments.

Would you like me to research the latest interest rates for consolidation loans to help you choose a strategy?