Financial freedom often feels unattainable when inflation rises and wages stagnate across the globe. Saving money does not necessarily require a drastic reduction in your quality of life or the complete abandonment of joy. Small adjustments to daily habits can accumulate into substantial savings over the course of a year. The following strategies focus on effortless efficiency and smart substitutions rather than painful deprivation. Adopting just a few of these methods can help regain control over your budget while maintaining a comfortable lifestyle.

Generic Brand Pharmaceuticals

Many consumers overlook the substantial price difference between name brand medication and their generic counterparts. Regulatory agencies require generic drugs to have the same active ingredients and effectiveness as the more expensive versions. You can often save fifty percent or more simply by asking your pharmacist for the generic option. The packaging may look different but the relief provided remains exactly the same. This switch offers an immediate reduction in medical expenses without impacting your health outcomes.

Library Digital Services

Modern libraries offer far more than just physical books on dusty shelves. Most library systems now provide free access to e-books and audiobooks along with movie streaming services. You can download these materials directly to your tablet or phone without leaving your home. This eliminates the need for multiple monthly subscriptions for entertainment and reading material. Utilizing these resources maximizes tax dollars you already pay while keeping your personal entertainment budget at zero.

LED Light Bulbs

Switching to LED bulbs is one of the most effective ways to lower electricity bills over time. These bulbs use significantly less energy than traditional incandescent options and last for many years. The initial investment pays for itself quickly through reduced monthly utility payments. You will also spend less time and money replacing burnt out bulbs around your home. This simple hardware update creates passive savings every time you flip a light switch.

Meal Planning

Creating a weekly menu prevents impulse purchases and reduces food waste significantly. You can purchase exactly what you need when you enter the grocery store with a specific list in hand. This strategy eliminates the stress of last minute decisions that often lead to ordering expensive takeout. Planning meals around sales and seasonal produce further lowers the cost per plate. A disciplined approach to grocery shopping ensures every dollar spent contributes directly to a meal.

Subscription Audits

Automatic payments often hide forgotten subscriptions that drain bank accounts silently. Reviewing bank statements allows you to identify and cancel services you no longer use or value. Many streaming platforms and app subscriptions renew without notice and essentially waste money every month. Consolidating these services or rotating them based on what you actually watch can save hundreds annually. This administrative task takes very little time but offers immediate financial relief.

Water Heater Adjustments

lowering the temperature on your water heater to 120 degrees Fahrenheit saves energy without sacrificing comfort. Most manufacturers set the default temperature much higher than necessary for daily use. This adjustment prevents the unit from working overtime to maintain scalding hot water. You also reduce the risk of accidental burns for children and guests in your home. It is a set it and forget it method for lowering utility costs permanently.

Home Brewing Coffee

Buying a high quality coffee maker often costs less than a month of daily cafe visits. Brewing coffee at home gives you complete control over the ingredients and allows for premium bean selection. You can invest in a travel mug to take your beverage with you on your morning commute. The daily ritual becomes more personal and far less expensive than waiting in line at a shop. This habit change keeps significant cash in your pocket without removing your morning caffeine fix.

Thrift Store Finds

Second hand stores offer high quality clothing and household goods at a fraction of retail prices. You can often find designer labels and durable furniture that have barely been used. Shopping at these locations reduces landfill waste and gives items a second life. The thrill of the hunt adds an element of entertainment to the necessity of shopping. You curate a unique style while spending significantly less than department store shoppers.

Meatless Meals

Incorporating plant based meals a few times a week lowers grocery bills substantially. Meat is often the most expensive component of any dish and can easily be replaced with beans or lentils. These protein sources are shelf stable and cost pennies per serving compared to beef or chicken. Exploring vegetarian recipes expands your culinary skills and introduces variety to your diet. This dietary shift benefits both your wallet and the environment simultaneously.

Air Drying Laundry

Using a drying rack or clothesline extends the life of your garments and saves electricity. The heat and tumbling of a machine dryer break down fibers and fade colors over time. Air drying preserves the elasticity of activewear and keeps delicate fabrics in pristine condition. You eliminate a major energy consumer from your utility bill with this gentle method. Your clothes look newer for longer which reduces the frequency of replacement shopping.

Programmable Thermostats

Automating your home temperature ensures you never heat or cool an empty house. You can program the system to adjust settings while you are at work or asleep. Modern smart thermostats learn your schedule and optimize energy usage for maximum efficiency. This technology prevents energy waste and ensures you return to a comfortable environment. The savings on heating and cooling costs often cover the device price within a year.

Bulk Buying

Purchasing nonperishable items in large quantities reduces the unit price significantly. Essential goods like toilet paper and cleaning supplies are perfect candidates for bulk purchasing. You reduce the number of trips to the store which saves both time and fuel. Proper storage organization is key to making this strategy work effectively in smaller homes. This approach works best for items you know you will inevitably use.

Public Transportation

Utilizing buses or trains eliminates the costs associated with parking and fuel and vehicle maintenance. Many employers offer subsidized transit passes to encourage eco friendly commuting. You can use the travel time to read or work instead of focusing on stressful traffic. This shift reduces wear and tear on your personal vehicle and lowers insurance premiums if you drive less. It provides a reliable and cost effective alternative to daily driving.

Free Community Events

Cities often host concerts and festivals and outdoor movie nights at no cost to residents. checking local community calendars reveals a wealth of entertainment options that require no admission fee. These events provide opportunities to socialize and enjoy cultural experiences without spending money. You can enjoy high quality performances and art installations funded by municipal budgets. This allows you to maintain an active social life while adhering to a strict budget.

Selling Unused Items

Decluttering your home can generate immediate cash through online marketplaces or garage sales. Items sitting in closets or basements often hold value for other people looking for a deal. You reclaim physical space in your living environment while padding your savings account. This process forces you to evaluate what you truly need and value. It turns potential trash into treasure for someone else and income for you.

Water at Restaurants

Ordering tap water instead of sodas or alcoholic beverages slashes the bill when dining out. Restaurants have high markups on drinks which can sometimes equal the cost of an entrée. Water is healthier and cleanses the palate better than sugary alternatives. You can still enjoy the restaurant experience and the food without the inflated beverage costs. This simple request makes dining out a more affordable luxury.

Repair Skills

Learning basic sewing or repair skills extends the life of clothing and household items. Fixing a loose button or patching a small tear takes minutes but saves the cost of replacement. There are countless online tutorials available to guide you through simple fixes for common problems. This self sufficiency reduces dependency on professional services and manufacturing. You gain a sense of accomplishment along with your financial savings.

Cashback Applications

Using apps that offer rebates on purchases you are already making earns passive income. You simply scan receipts or link your credit card to accumulate points or cash rewards. These small amounts add up over time and can be redeemed for gift cards or direct deposits. There is no extra spending required to benefit from these marketing programs. It essentially acts as a retroactive discount on your regular shopping trips.

Bill Negotiation

Service providers for internet and cable and insurance are often willing to lower rates to retain customers. Calling customer service to ask for available promotions or loyalty discounts is a powerful tactic. You can leverage competitor offers to secure a better deal on your current plan. This conversation takes only a few minutes but can result in monthly savings for a year or more. It is a business transaction where your loyalty is the currency.

Unplugging Electronics

Devices often draw power even when they are turned off which is known as phantom energy load. Unplugging chargers and appliances when not in use stops this unnecessary electricity drain. Using power strips makes it easy to cut power to multiple devices with a single switch. This habit protects electronics from power surges while lowering your utility bill. It is a small physical action that contributes to measurable energy efficiency.

Homemade Cleaners

Mixing vinegar and baking soda and water creates effective cleaning solutions for a fraction of the cost. Commercial cleaners often contain harsh chemicals and come with a high price tag for brand recognition. Homemade versions are generally safer for pets and children and the environment. You can reuse spray bottles to further reduce waste and expense. This switch simplifies your cleaning cabinet and your shopping list.

Packed Lunches

Bringing leftovers or a sandwich to work saves a significant amount compared to buying lunch daily. You control the portion sizes and nutritional content of your midday meal. This habit eliminates the time spent waiting in lines during your limited break time. The accumulated savings from this single change can fund a vacation or major purchase. It is a dietary choice that supports both health and financial goals.

The 24 Hour Rule

Waiting a full day before making a nonessential purchase curbs impulse buying effectively. The initial excitement of seeing an item often fades after a cooling off period. You give yourself time to consider if the purchase fits your budget and your actual needs. This pause prevents buyer’s remorse and keeps clutter out of your home. It introduces mindfulness into your consumption habits.

Loyalty Programs

Signing up for store loyalty programs unlocks exclusive discounts and coupons for members. These programs often track your purchasing habits to offer relevant deals on things you actually buy. You can accumulate points towards free items or significant percentages off future trips. It costs nothing to join and usually requires only a phone number at checkout. This maximizes the value of every dollar you spend at that retailer.

Outdoor Exercise

Running or hiking outside provides excellent physical conditioning without a gym membership fee. Parks and trails offer scenic environments that can be more motivating than a crowded fitness center. You get the added benefit of fresh air and vitamin D exposure during your workout. Many communities have outdoor fitness stations that rival indoor equipment. This approach makes fitness accessible and free for everyone.

Shower Timers

Limiting shower time reduces water consumption and the energy used to heat that water. A simple waterproof timer or a favorite song can keep your routine on track. Even shaving a few minutes off your daily shower accumulates to massive savings annually. You conserve a vital natural resource while lowering two different utility bills. This discipline promotes efficiency in your morning routine.

Potluck Gatherings

Hosting potluck dinners allows you to entertain friends without bearing the full cost of catering. Guests contribute dishes which adds variety to the meal and shares the financial burden. This format encourages culinary creativity and ensures there is plenty of food for everyone. It shifts the focus from the host providing everything to the community sharing an experience. Socializing remains a priority without the high price tag.

Freezer Optimization

Freezing leftovers and excess produce prevents food spoilage and provides quick meals for busy nights. You can buy meat on sale and store it for weeks or months until needed. A well stocked freezer acts as a backup pantry that reduces the need for emergency grocery runs. Proper labeling and organization ensure you use items before they develop freezer burn. This appliance becomes a tool for long term budget management.

Reusable Water Bottles

Carrying a durable water bottle eliminates the need to purchase single use plastic bottles while out. Most public places offer fountains or filling stations for free hydration. You reduce plastic waste significantly and avoid the markup on bottled water. This one time purchase pays for itself within a few uses. It ensures you always have access to water without opening your wallet.

Window Insulation

Sealing drafty windows with weatherstripping or plastic film keeps heated or cooled air inside. Poor insulation forces your HVAC system to work harder to maintain the desired temperature. These materials are inexpensive and easy to apply without professional help. You improve the comfort of your home by eliminating cold drafts near windows. This maintenance task yields high returns in energy savings.

Herb Gardens

Growing fresh herbs on a windowsill or balcony costs less than buying cut herbs at the store. A single plant produces continuously and provides better flavor than dried alternatives. You eliminate the plastic packaging waste associated with store bought herbs. Gardening offers a relaxing hobby that also contributes directly to your kitchen. You have fresh ingredients available instantly whenever you cook.

Clothing Swaps

Organizing a swap party with friends refreshes your wardrobe without spending any money. You trade items you no longer wear for pieces that are new to you. This social event turns decluttering into a fun and productive gathering. It extends the lifecycle of clothing and prevents fast fashion consumption. You walk away with a “new” wardrobe completely for free.

Matinee Movies

Going to the theater during the day offers significantly lower ticket prices than evening showings. You enjoy the same cinematic experience on the big screen with fewer crowds. Many theaters also offer discounts on concessions during these earlier hours. This allows you to support the arts and enjoy movies without the premium cost. It requires a flexible schedule but offers great value.

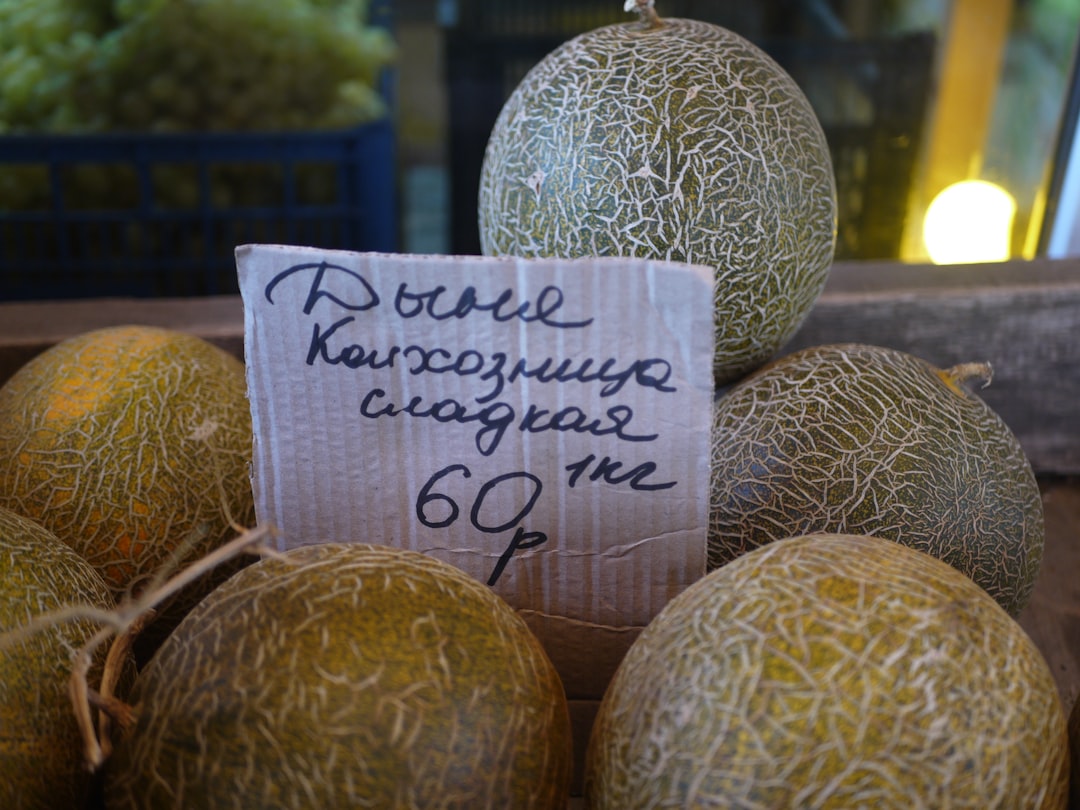

Whole Foods

Buying fruits and vegetables in their whole form is cheaper than purchasing pre-cut versions. The convenience of chopped onions or melon comes with a steep price increase for labor. processing the food yourself takes only a few minutes and ensures maximum freshness. You also avoid the extra plastic packaging used for prepared produce. This choice rewards a small amount of effort with lower grocery receipts.

Cold Water Wash

Washing clothes in cold water cleans them effectively while saving the energy used to heat water. Modern detergents are formulated to work perfectly in lower temperatures. This setting is gentler on fabrics and prevents shrinking and fading. You reduce your carbon footprint and your utility bill with a simple dial adjustment. It is the standard recommendation for most contemporary clothing care.

Tire Pressure

Keeping vehicle tires properly inflated improves gas mileage and extends the life of the treads. Underinflated tires create more rolling resistance which forces the engine to burn more fuel. You can check and fill tires at many gas stations for a nominal fee or for free. This safety measure prevents blowouts and ensures better handling on the road. It is a critical part of vehicle maintenance that saves money at the pump.

Leftover Creativity

Transforming last night’s dinner into a new meal prevents boredom and food waste. Roasted vegetables can become a frittata and grilled chicken can top a fresh salad. Internet recipes abound for repurposing common leftovers into entirely different dishes. This culinary skill stretches your grocery budget further by utilizing every scrap of food. You eat well without constantly starting from scratch.

DIY Gifts

Creating handmade gifts adds a personal touch that store bought items often lack. A framed photo or baked goods or a knitted scarf shows thought and effort. These gifts are often cherished more because of the time invested in their creation. You save money on expensive retail markups while giving something unique. This approach values sentiment and creativity over price tags.

Streaming Rotation

Subscribing to one streaming service at a time allows you to binge watch specific content before cancelling. You can then switch to a different platform to catch up on their exclusive shows. This method prevents paying for multiple services that sit unused for weeks. You avoid the high cost of maintaining a comprehensive entertainment package. It requires active management but saves significant money annually.

Happy Hour

Visiting bars and restaurants during happy hour unlocks discounted food and drink menus. You can enjoy the social atmosphere and professional service at a reduced rate. Many establishments offer substantial portions that can serve as an early dinner. This strategy allows for regular socializing without blowing the entertainment budget. You get the full experience for a fraction of the prime time price.

Second Hand Furniture

Buying used furniture from online listings or estate sales saves huge amounts over new retail. older furniture is often constructed with solid wood and better craftsmanship than modern budget pieces. You can refinish or paint items to match your decor perfectly. This sustainable choice keeps bulky items out of landfills. You furnish your home with character and quality on a budget.

Capsule Wardrobe

Curating a collection of versatile and coordinating clothes reduces the urge to shop constantly. A capsule wardrobe focuses on quality basics that can be mixed and matched endlessly. You spend less time deciding what to wear and less money on trends that fade quickly. This minimalist approach streamlines your closet and your morning routine. You invest in pieces that last rather than disposable fashion.

Loan Refinancing

Checking current interest rates for potential refinancing can lower monthly payments on large loans. Mortgages and student loans and auto loans are all eligible for this potential savings. A lower rate reduces the total interest paid over the life of the loan significantly. This financial move requires paperwork but offers long term structural relief for your budget. It frees up monthly cash flow for other priorities.

Automated Savings

Setting up automatic transfers to a savings account treats saving like a mandatory bill. You adjust your spending to accommodate the remaining balance in your checking account. This “pay yourself first” method builds an emergency fund without conscious effort. It removes the temptation to spend that money before it can be saved. Your financial security grows steadily in the background.

Seasonal Eating

Purchasing produce that is in season ensures the best flavor and the lowest prices. Out of season items must be shipped from far away which adds transportation costs to the price. Local farmers markets often have the best deals on current harvest crops. This habit introduces natural variety to your diet throughout the year. You enjoy fresher food while supporting local agriculture and saving money.

Credit Card Points

Using a rewards credit card for planned purchases earns points that can be redeemed for travel or cash. This strategy works only if you pay the balance in full every month to avoid interest. You essentially get a small discount on everything you buy through the rewards program. Many cards offer sign up bonuses that are worth hundreds of dollars. It leverages your normal spending to generate extra value.

Community Classes

Taking courses at a community college or recreation center is cheaper than private instruction. You can learn languages or pottery or coding for a modest fee. These institutions are subsidized to provide affordable education to the public. You gain new skills and social connections in a structured environment. It is a cost effective way to invest in your personal growth.

Home Entertainment

Inviting friends over for game nights or dinner parties replaces expensive nights out on the town. You control the music and the food and the atmosphere in your own space. Guests can bring beverages or snacks to share the cost of the gathering. This intimate setting often leads to better conversation and connection than a loud bar. You build stronger relationships while keeping your entertainment budget intact.

Please share your own favorite money-saving tips in the comments to help others discover new ways to save.