Building wealth involves more than just earning a high income since keeping that money is equally important. Many self-made millionaires share a common mindset that prioritizes value and long-term utility over short-term gratification. Identifying spending leaks is a crucial step for anyone looking to improve their financial standing. This list explores common expenditures that wealthy individuals typically sidestep to preserve their capital.

Brand New Cars

The depreciation hit on a brand new vehicle happens the moment it drives off the lot. Savvy investors prefer buying slightly used cars to let the original owner take that initial financial loss. Reliable transportation is the goal rather than impressing strangers with the latest model year. Leasing vehicles continuously is another money pit that prevents true asset ownership. Keeping a well-maintained car for a decade is a common trait among the financially independent.

Fast Fashion

Wealthy individuals often prioritize quality over quantity when building their wardrobes. Cheap clothing items tend to wear out quickly and require frequent replacement over time. Investing in timeless staple pieces reduces the long-term cost per wear significantly. Millionaires understand that looking expensive does not require buying a new outfit for every single occasion. A capsule wardrobe of high-quality fabrics saves money and decision fatigue simultaneously.

Impulse Purchases

Retail therapy provides a momentary dopamine rush that often leads to buyer’s remorse. Wealthy people usually implement a waiting period before making non-essential purchases. This pause allows them to determine if the item is a genuine need or a fleeting want. Avoiding spontaneous buys keeps more cash available for investments and experiences. Strict adherence to a shopping list prevents marketing tactics from influencing spending behavior.

Lottery Tickets

Gambling on lottery tickets is mathematically viewed as a tax on those who do not understand probability. Self-made millionaires rely on calculated risks and consistent investing rather than luck. The odds of winning a massive jackpot are infinitesimally small compared to the certainty of compounding interest. That money is better utilized in a diversified index fund or savings account. Building wealth requires actionable plans instead of hoping for a miraculous windfall.

Extended Warranties

Retailers push extended warranties because they are highly profitable products for the store. Most modern electronics and appliances are reliable enough to outlast these expensive protection plans. The cost of the warranty often exceeds the price of a potential repair. Many credit cards already offer extended warranty protection as a standard perk for cardholders. Self-insuring by setting that cash aside in an emergency fund is a smarter financial move.

High-Interest Credit Card Debt

Carrying a balance on a credit card erodes wealth faster than almost any other financial habit. Millionaires use credit cards for convenience and rewards but always pay the full balance monthly. Paying interest rates that exceed average investment returns is mathematically counterproductive. Financial freedom requires eliminating toxic debt that compounds against you. Using credit responsibly builds a score without costing a cent in interest fees.

Bottled Water

Purchasing individual bottles of water is an expenditure that adds up significantly over a year. Wealthy individuals typically invest in a high-quality home filtration system and a reusable bottle. This habit is better for both the wallet and the environment. Tap water in many developed nations is strictly regulated and safe to drink. Paying a premium for plastic packaging and marketing is generally seen as unnecessary waste.

Unused Gym Memberships

Signing up for a fitness center in January and forgetting about it by March is a common financial drain. Wealthy people value their health but they also value the utilization of what they pay for. Many opt for home gyms or outdoor activities that do not require a recurring monthly fee. If a membership is purchased it is used consistently to ensure a return on investment. Automatic renewals often go unnoticed by those who do not track their expenses closely.

Cable Television

The rising cost of cable packages has led many financially savvy people to cut the cord entirely. Paying for hundreds of channels that are never watched is an inefficient use of entertainment funds. Targeted streaming services allow viewers to pay only for the content they actually consume. Time spent mindlessly flipping through channels is often redirected toward productive hobbies or learning. Curating a specific list of subscriptions keeps monthly fixed costs manageable.

Daily Coffee Shop Visits

The daily habit of buying expensive lattes is a classic example of small leaks sinking great ships. Making coffee at home costs a fraction of the price charged at trendy cafes. Millionaires often view coffee as a utility rather than a daily luxury experience. Investing in a quality coffee maker pays for itself within a few months of use. Those savings can be automatically redirected into an investment account to grow over time.

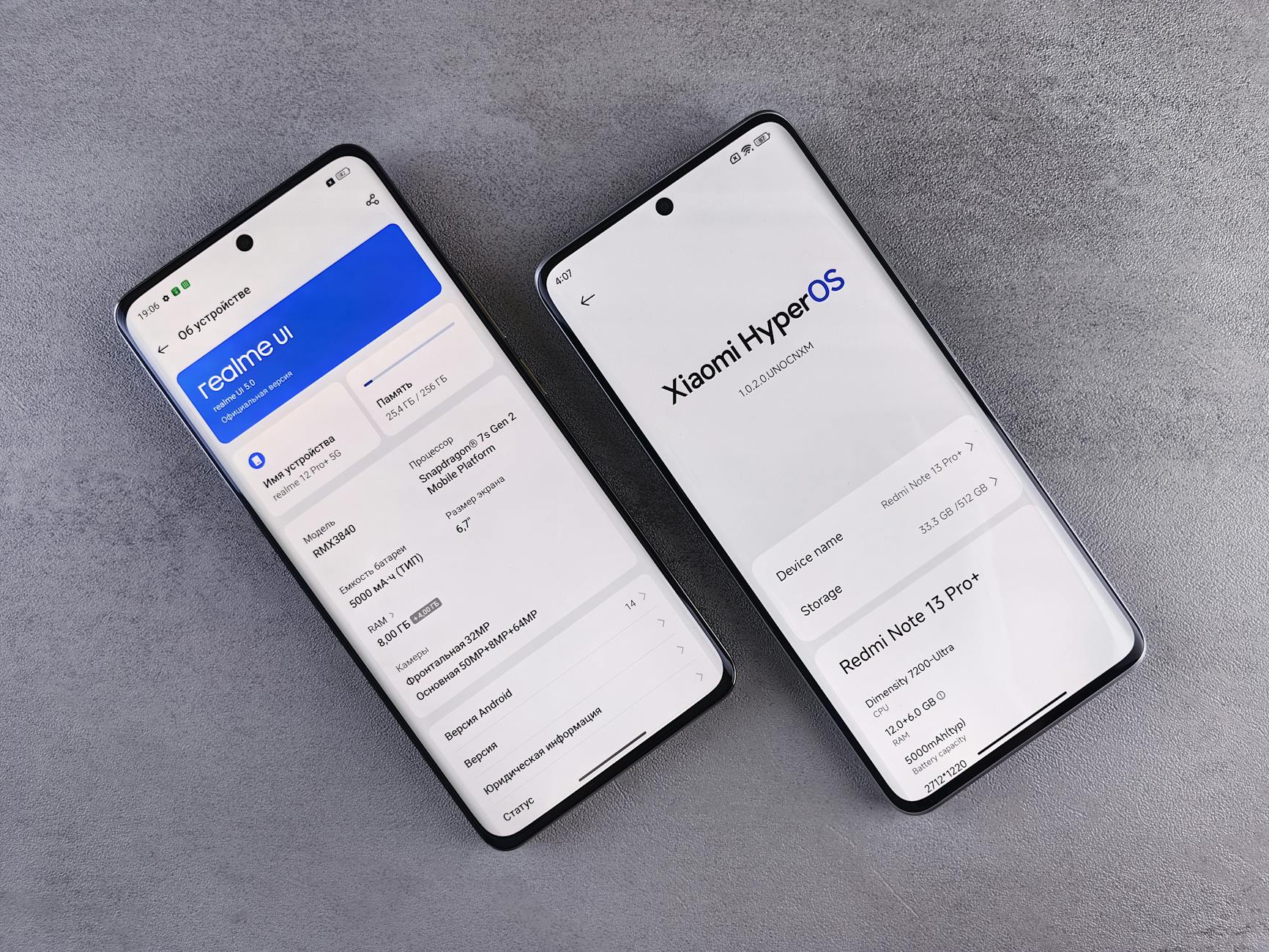

The Latest Tech Upgrades

Upgrading a smartphone every single year provides diminishing returns on functionality. Wealthy individuals usually keep their electronics until they break or become obsolete. The marginal improvements in camera quality or processing speed rarely justify the high price tag. Waiting a few generations between upgrades offers a much more significant leap in technology. Resisting the hype cycle prevents thousands of dollars from being wasted on minor iterations.

Overpriced Brand Name Groceries

Generic or store-brand products often contain the exact same ingredients as their famous counterparts. Marketing campaigns convince consumers that the expensive version tastes better or is healthier. Millionaires often shop with a value mindset and compare unit prices regardless of the label. Buying staples in bulk is another strategy used to lower the household food bill. Being brand loyal is often an emotional attachment rather than a logical financial decision.

Late Fees

Paying extra money simply because a bill was forgotten is a completely avoidable expense. Wealthy people automate their finances to ensure every payment is made on time. This habit protects their credit score and keeps money in their pocket. Late fees provide absolutely no value and are purely a penalty for disorganization. Setting up calendar reminders or direct debits eliminates this waste entirely.

Bank Account Fees

Paying a monthly maintenance fee for a checking or savings account is unnecessary in the modern banking landscape. Millionaires ensure they meet minimum balance requirements or switch to fee-free institutions. Many online banks offer superior services without the overhead costs passed on to customers. ATM fees are another cost that can be avoided with proper planning. Scrutinizing bank statements helps catch and eliminate these silent wealth eroders.

Redundant Streaming Subscriptions

It is easy to accumulate multiple subscriptions that offer overlapping content libraries. Wealthy individuals regularly audit their recurring charges to cancel services they no longer use. Rotating services month-to-month allows for variety without the high cumulative cost. Paying for music, movies, and audiobooks simultaneously can create a bloated monthly budget. Intentional consumption ensures that every dollar spent on entertainment provides genuine value.

Fast Food Dining

Frequent trips to fast food chains are detrimental to both health and net worth. The cost of a combo meal has risen to a point where home cooking is significantly cheaper. Medical bills associated with a poor diet can become a major financial burden later in life. Millionaires often view food as fuel and prioritize nutritious meals that sustain their energy. Meal prepping is a common tool used to avoid the convenience tax of drive-thru windows.

Designer Baby Clothes

Babies outgrow their clothing in a matter of weeks or months making expensive outfits a poor investment. Wealthy parents often accept hand-me-downs or buy standard clothing for everyday use. The infant has no concept of brand names or fashion trends. Saving that money for a college fund or trust produces a much greater benefit for the child. Practicality rules the nursery when financial efficiency is the goal.

Trendy Home Decor

Filling a home with items that are currently in style guarantees they will look dated quickly. Millionaires tend to favor classic interior design elements that stand the test of time. Constantly updating furniture and accents to match the latest fad is an endless expense. High-quality pieces are purchased once and maintained for years or even generations. A neutral base allows for small and inexpensive updates rather than complete overhauls.

Storage Units

Paying rent for a space to house items that are rarely used is a sign of excessive accumulation. Wealthy individuals usually adopt a philosophy of keeping only what is useful or beautiful. If an item is not needed in the home it is often sold or donated rather than stored. The annual cost of a storage unit often exceeds the replacement value of the contents inside. Decluttering is a free alternative that frees up both physical space and monthly cash flow.

In-App Purchases

Microtransactions in mobile games and apps are designed to be addictive and deceptively expensive. Spending real money on virtual gems or extra lives provides no tangible return. Millionaires generally avoid freemium games that require constant payments to progress. Entertainment budgets are better spent on complete experiences rather than piecemeal digital content. Blocking these purchases on devices prevents accidental or impulsive spending.

Pre-Cut Vegetables and Fruit

Grocery stores charge a massive premium for the convenience of sliced produce. Buying whole fruits and vegetables and spending a few minutes prepping them saves significant money. The shelf life of pre-cut items is also much shorter than their whole counterparts. Wealthy shoppers are willing to trade a small amount of labor for better quality and lower prices. This simple switch in the produce aisle can reduce the weekly grocery bill noticeably.

Expensive Cleaning Products

Specialized cleaners for every surface in the house are largely a result of clever marketing. Simple ingredients like vinegar and baking soda can clean most areas effectively for pennies. Millionaires avoid cluttering their cabinets with single-purpose plastic bottles. Multi-surface concentrates that can be diluted at home are a more economical choice. Reducing chemical usage is often a secondary benefit of this frugal switch.

Single-Use Kitchen Gadgets

Items like banana slicers or strawberry hullers take up drawer space and offer limited utility. Professional chefs and wealthy home cooks rely on a few high-quality knives to do the work. These plastic gadgets often break easily and end up in landfills. Investing in skill development is more valuable than buying a tool for every specific task. A minimalist kitchen is more functional and cheaper to equip.

Luxury Bedding

While quality sleep is essential the price gap between good sheets and luxury designer linens is vast. High thread count is often a marketing gimmick rather than a true indicator of comfort. Wealthy buyers look for material quality like long-staple cotton rather than a brand name on the packaging. Durable bedding that washes well provides the best value over time. Paying thousands for sheets does not guarantee a better night of rest.

Paper Plates and Utensils

Using disposable tableware for daily meals is throwing money directly into the trash. Investing in a durable set of dishes and silverware is a one-time cost that lasts for decades. The environmental impact of constant waste is another reason many avoid this habit. Washing dishes is a small trade-off for the savings accumulated over a lifetime. Elegant dining experiences at home require real plates and cutlery.

Greeting Cards

The price of a standard greeting card has inflated to a level that shocks many frugal consumers. Wealthy individuals often prefer writing personal notes on high-quality stationery. A box of blank cards is significantly cheaper per unit than buying individual cards for each occasion. The sentiment of a handwritten message is valued more than a generic printed rhyme. Digital alternatives or phone calls also replace this antiquated and costly tradition.

Identity Theft Protection Services

Many people pay monthly fees for protection that they can legally set up for themselves for free. Freezing credit reports at the three major bureaus is the most effective way to prevent identity theft. Monitoring financial statements regularly is a habit that costs nothing but time. Many banks and credit cards offer free credit monitoring as part of their service. Paying a third party to watch your credit is often a redundancy.

Pet Clothing

Unless a dog has a medical need for warmth dressing pets in outfits is purely for the owner’s amusement. These items are often uncomfortable for the animal and represent discretionary spending gone wrong. Wealthy pet owners prioritize high-quality food and veterinary care over fashion. The pet does not care about looking trendy at the park. This money is better saved for unexpected medical emergencies involving the animal.

First-Class Domestic Flights

Flying first class on short domestic routes provides a poor return on investment for the extra cost. The destination remains the same regardless of which side of the curtain you sit on. Many wealthy travelers fly economy for short trips and save upgrades for long-haul international flights. Using points or miles is the preferred method for luxury travel rather than paying cash. Arriving safely and on time is the primary objective of air travel.

Boat Ownership

Boats are famously described as holes in the water into which you pour money. The costs of docking and maintenance and fuel often surprise new owners. Renting a boat for a day allows for the enjoyment of the water without the liabilities of ownership. Many millionaires prefer to charter vessels when they want to sail. Avoiding the depreciation and upkeep of a boat preserves capital for appreciating assets.

Tell us which of these expenses you plan to cut from your budget in the comments.