Online fraud has evolved into a sophisticated industry targeting people from all walks of life. Recognizing the subtle signs of deception is the most effective defense against financial loss. This comprehensive guide outlines specific red flags and behavioral patterns frequently exhibited by cybercriminals. Awareness of these tactics empowers internet users to navigate the digital world with greater confidence and security.

Unsolicited Tech Support Calls

Legitimate technology companies rarely contact customers out of the blue to report a problem. Scammers often claim your computer has a virus and demand immediate payment to fix it. They may ask for remote access to your device to install malicious software or steal personal data. You should always hang up and contact the company directly using a verified phone number from their official website.

Requests for Remote Access

Granting someone remote control of your computer exposes your banking information and personal files to theft. Fraudsters use this tactic to manipulate your screen and make it look like they are refunding money or fixing an issue. They often blank out the monitor so you cannot see them transferring funds from your accounts. No honest bank or service provider will ever ask for control of your desktop.

Payment via Cryptocurrency

Criminals favor digital currencies because transactions are irreversible and difficult to trace. Legitimate businesses and government agencies do not demand payment in Bitcoin or other cryptocurrencies. A request to convert cash into crypto at a kiosk is a major warning sign of a scam in progress. You should treat any demand for digital currency payment as an immediate threat to your finances.

Grammar and Spelling Mistakes

Professional organizations employ editorial teams to ensure their communications are polished and error-free. Phishing emails and fake websites often contain awkward phrasing or obvious typos that indicate a lack of professionalism. These errors frequently result from non-native speakers using translation software to generate text. paying attention to the quality of writing can save you from clicking a malicious link.

Generic Greetings

Banks and service providers typically address their customers by name in official correspondence. Scammers send mass emails to thousands of people and use vague salutations like Dear Customer or Dear Member. This lack of personalization suggests the sender does not actually know who you are or have a relationship with you. A generic greeting is often the first clue that an email is a phishing attempt.

High-Pressure Urgency

Fraudsters try to override your critical thinking by creating a false sense of emergency. They might claim your account will be suspended or legal action will be taken if you do not act immediately. This tactic is designed to make you panic and comply without verifying their claims. Taking a moment to pause and breathe allows you to see through the fabricated urgency.

Suspicious Email Domains

You should always inspect the sender address carefully before responding to an email. Scammers frequently spoof legitimate company names by making slight alterations or using public email providers. An official message from a large corporation will never come from a Gmail or Yahoo account. Mismatched domains are a clear indicator that the communication is not authentic.

Requests for Wire Transfers

Wire transfers act like digital cash and are nearly impossible to recover once sent. Scammers prefer this method because the money moves quickly and leaves little trail for law enforcement. Legitimate online sellers and businesses usually offer secure payment options like credit cards or PayPal. A rigid insistence on wire transfers suggests the recipient is trying to avoid buyer protection measures.

Too Good to Be True Prices

Luxury goods listed at a fraction of their retail price are almost always counterfeit or non-existent. Scammers set up fake online stores with incredible deals to harvest credit card numbers and personal information. These sites often disappear after a few weeks once they have collected enough money from victims. Comparing prices across multiple reputable retailers helps verify if a deal is realistic.

Love Bombing in Dating Apps

Romance scammers move relationships forward at an unnaturally fast pace to build trust quickly. They profess deep love and affection within days of matching despite never meeting in person. This emotional manipulation prepares the victim for an eventual request for money. You should be wary of anyone who claims you are their soulmate before a real conversation has occurred.

Overpayment Checks

This classic scam involves a buyer sending a check for more than the agreed purchase price. They ask the seller to deposit the check and wire back the difference before the bank realizes the check is fake. The victim is then held responsible by the bank for the full amount of the bad check. You must never accept a check for more than the selling price under any circumstances.

Fake Shipping Notifications

Cybercriminals send emails resembling delivery updates from major couriers to trick you into clicking malicious links. These messages often claim a package is delayed or requires a small fee for redelivery. Clicking the link usually leads to a site designed to steal your credit card information or login credentials. It is safer to track packages directly through the retailer’s official website or app.

Government Impersonation

Agencies like the IRS or Social Security Administration generally initiate contact through conventional mail. Scammers call or email pretending to be federal agents to demand payment for back taxes or fines. They often use threatening language and claim police are on their way to arrest you. You should disconnect immediately and contact the agency through their official public channels.

Unverified Charity Requests

Tragedies and natural disasters often trigger a wave of fake charity scams looking to exploit your empathy. These fraudulent organizations set up convincing websites and crowdfunding campaigns to steal donations. They often use names that sound very similar to well-known and reputable charities. Checking the organization against a watchdog database ensures your money actually reaches those in need.

Requests for Two-Factor Codes

Your two-factor authentication code is the final barrier protecting your accounts from unauthorized access. Scammers pretend to be a company representative helping you and ask you to read the code sent to your phone. Sharing this code grants them entry to your account and allows them to change your password. You must never share these verification codes with anyone.

Unexpected Attachments

Malicious software is frequently hidden inside email attachments masquerading as invoices or receipts. Opening these files can infect your computer with ransomware or spyware that steals your data. You should never download or open files from unknown senders or unexpected sources. Verifying the sender by phone is a smart precaution before opening any unsolicited document.

Lookalike Websites

Scammers create carbon copies of popular banking or shopping websites to trick you into entering your credentials. These sites use URLs that are slightly different from the real ones by swapping letters or changing the extension. Entering your username and password on these pages hands your account directly to the criminals. You should manually type the web address or use a trusted bookmark to access important sites.

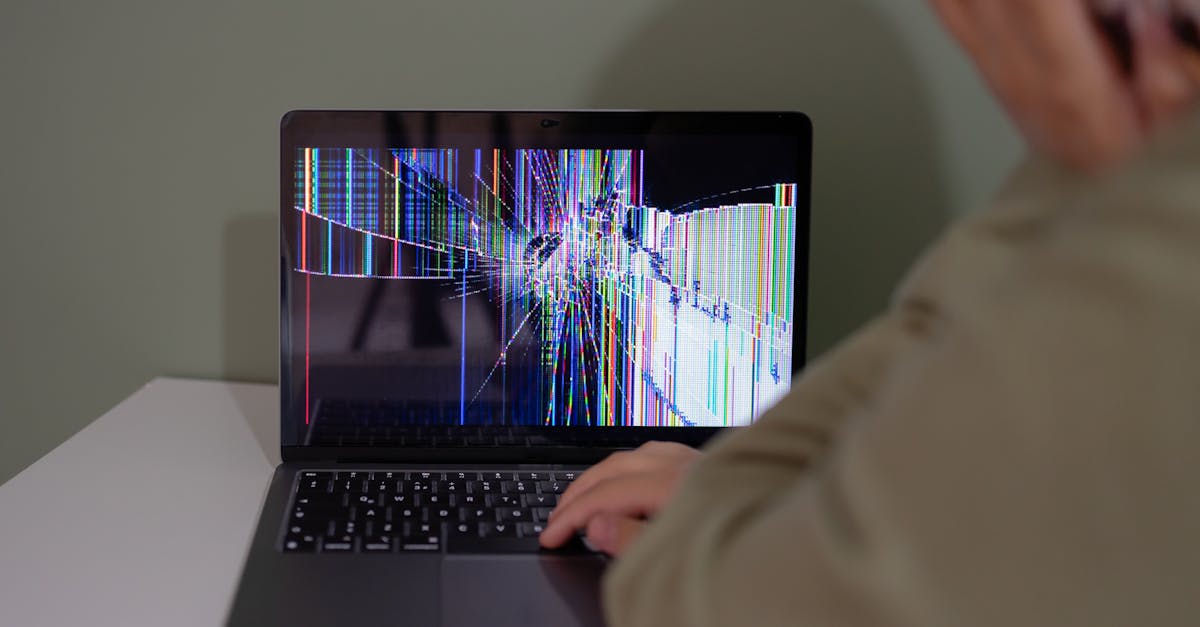

Pop-Up Virus Warnings

Browser pop-ups claiming your computer is infected are almost always scare tactics designed to defraud you. These alerts often feature loud alarms or flashing lights to create panic and prompt you to call a fake support number. Legitimate antivirus software operates in the background and does not hijack your browser with full-screen warnings. Closing the browser tab or restarting the computer usually resolves the issue.

Fake Job Offers

Employment scams prey on job seekers by offering high salaries for minimal work. These listings often require you to pay for training materials or equipment upfront before starting the job. Other variations ask for sensitive banking information under the guise of setting up direct deposit. legitimate employers will never ask you to pay money to get a job.

Interview via Chat Only

Professional companies conduct interviews via phone, video call, or in person to assess candidates. Scammers avoid voice or video communication to hide their identity and location. Conducting the entire hiring process through a text-based app is a major red flag. You should insist on a video or phone meeting to verify the legitimacy of the employer.

Advance Fee Loans

Predatory lenders target individuals with poor credit by guaranteeing loans in exchange for an upfront fee. They claim this fee covers insurance or processing costs but disappear once the money is paid. Legitimate lenders deduct fees from the loan amount rather than demanding payment beforehand. You should avoid any lender that guarantees approval without checking your credit history.

Lottery Winnings Without Entry

You cannot win a contest or lottery that you never entered in the first place. Scammers send notifications claiming you have won a massive prize to trick you into paying taxes or processing fees. These fees are the actual scam and the prize money does not exist. Ignoring these notifications is the only way to avoid losing money.

Social Media Quizzes

Fun quizzes on social platforms are often designed to harvest answers to common security questions. Questions about your first pet or the street you grew up on provide hackers with data to crack your accounts. Engaging with these posts exposes your personal information to data aggregators and potential scammers. It is safer to scroll past these quizzes to protect your privacy.

Friends Requesting Money

Hackers often take over social media accounts and message the victim’s friends asking for emergency funds. The messages usually claim the person is stranded or in trouble and needs money immediately. The writing style often differs from how your friend normally communicates. calling your friend directly on their phone is the best way to verify if the request is real.

Fake Invoices

Businesses frequently receive fraudulent bills for services like domain hosting or office supplies they never ordered. The scammers hope the accounting department will pay the invoice automatically without verification. These documents look professional and often include threatening language about late fees. You must verify every invoice against purchase orders and confirmed deliveries.

Refusal to Meet in Person

Local marketplace sellers who refuse to meet in public often have something to hide. They may ask for payment to be shipped or transferred electronically before you see the item. This behavior suggests the item does not exist or the seller is not local. Meeting in a safe public location is essential for local transactions.

Brand New Social Profiles

Scammers constantly create new accounts as their old ones get reported and banned. A profile that was created just a few days or weeks ago should be viewed with suspicion. These accounts often have few friends and very little activity or history. checking the account creation date is a simple way to spot potential fraud.

Stock Photos on Profiles

Reverse image searching a profile picture can reveal if the person is using a stolen identity. Scammers often use photos of models or influencers found on the internet to create attractive personas. If the image appears on multiple other websites or belongs to a different person, it is a scam. Authentic users typically have unique photos that do not appear in stock image databases.

Seller Wants to Move Off Platform

Marketplaces like eBay and Poshmark have built-in protections for both buyers and sellers. Scammers try to move the conversation to email or text messages to circumvent these safety measures. Once off the platform, they can convince you to use unsecure payment methods. You should always keep communication and payments within the official platform ecosystem.

Counterfeit Escrow Services

Criminals set up fake escrow websites that look legitimate to reassure buyers during high-value transactions. They claim the money is held safely until the goods are received but actually pocket the funds immediately. These sites often have names resembling real escrow companies to confuse victims. You should only use established and verifiable escrow services recommended by trusted platforms.

Family Emergency Messages

The grandparent scam involves a caller pretending to be a grandchild in legal trouble or a hospital. They beg the victim to send money for bail or medical bills and plead with them not to tell their parents. The voice may sound different due to a bad connection or AI voice cloning technology. Verifying the story with another family member is crucial before sending any funds.

Spoofed Phone Numbers

Caller ID is no longer a reliable way to identify who is calling you. Scammers use technology to make their phone number appear as a local business or government agency. They rely on you picking up the phone because you recognize the area code or the name displayed. letting unknown calls go to voicemail allows you to screen them safely.

Secret Investment Opportunities

Fraudsters lure victims with promises of exclusive investment tips that guarantee high returns with zero risk. They use complex jargon and fake graphs to make the scheme look professional and profitable. Legitimate investing always involves some degree of risk and returns are never guaranteed. You should consult a licensed financial advisor before committing money to any unknown venture.

Requests for Private Info

Legitimate organizations do not ask for sensitive data like passwords or social security numbers via email or text. Scammers use these requests to steal your identity and access your financial accounts. They often claim they need to verify your identity to resolve a security issue. You should never provide sensitive personal information in response to an unsolicited message.

Unsubscribe Links in Spam

Clicking the unsubscribe link in a suspicious email often confirms to the spammer that your address is active. This confirmation can lead to a significant increase in the amount of spam you receive. The link may also download malware onto your device without your knowledge. deeply suspicious emails should be marked as spam and deleted without interaction.

Fake Antivirus Software

Scammers sell useless or malicious software marketed as essential security tools. These programs often mimic the look and feel of reputable antivirus brands. Installing them can compromise your system security rather than enhancing it. You should only download security software directly from the official websites of well-known vendors.

Rental Properties Unseen

Rental scams involve listing properties that the “landlord” does not actually own or have access to. They demand a security deposit or first month’s rent before allowing you to view the apartment. They often claim to be out of the country and unable to show the unit in person. You should never transfer money for a rental without seeing the property inside and out.

Mystery Shopper Scams

This scam offers you a job as a mystery shopper and sends you a fake check to cover your purchases. You are instructed to buy gift cards and send the codes to the “employer” as part of your assignment. The check eventually bounces and you are left with the cost of the gift cards. Legitimate mystery shopping companies do not operate in this manner.

Unexpected Password Resets

Receiving a password reset email you did not request indicates someone is trying to breach your account. The scammer hopes you will click the link or ignores the notification while they continue their attack. It serves as an immediate warning to secure your account with a strong new password. You should log in directly through the site rather than clicking links in the email.

Threatening Legal Action

Scammers use fear and intimidation to force victims into compliance. They may claim a warrant has been issued for your arrest or that you are being sued. These threats are designed to make you act irrationally to avoid the perceived consequences. Real legal matters are handled through formal written channels and not through aggressive phone calls.

Share your own experiences or tips for staying safe online in the comments.